- Get link

- X

- Other Apps

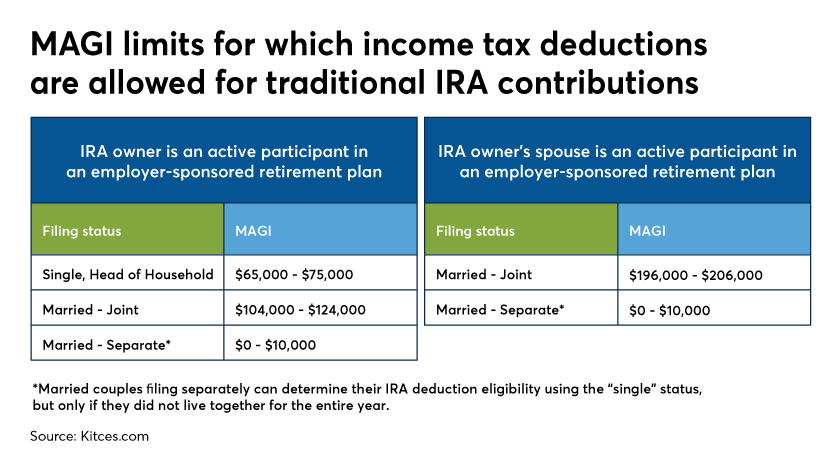

Your IRA might be required to file IRS Forms 990-T or 990-W and pay estimated income taxes during the year. Thats because if you get an up-front deduction on your IRA contribution then the IRS wants to get its.

Traditional Iras And Roth Iras Are Long Term Savings Vehicles

Traditional Iras And Roth Iras Are Long Term Savings Vehicles

If your IRA earns UBTI exceeding 1000 you must pay taxes on that income.

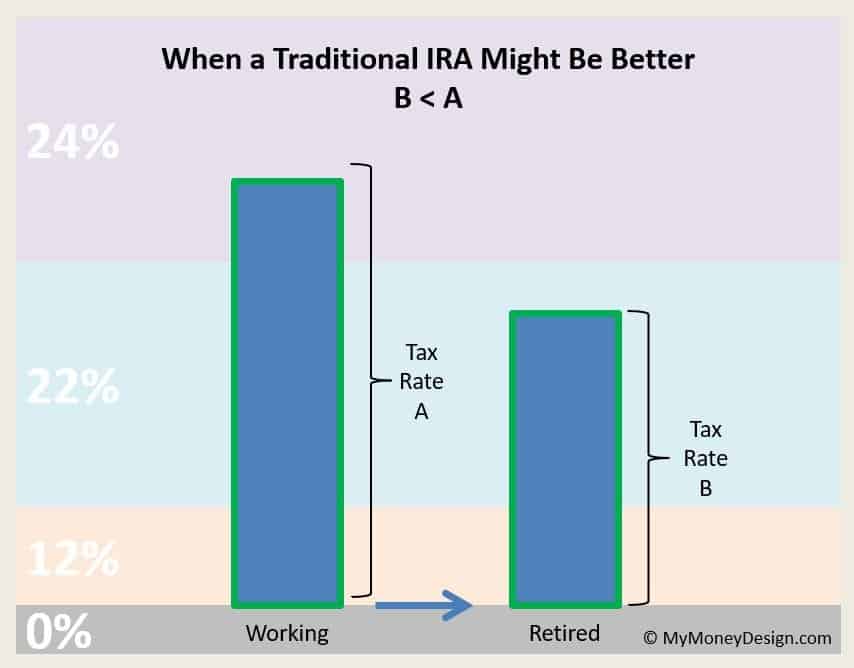

When do you pay taxes on traditional ira. See IRA Resources for links to videos and other information on IRAs. All distributions are taxable. Whenever you take money from a traditional IRA you have to pay taxes at your ordinary or marginal income tax rate.

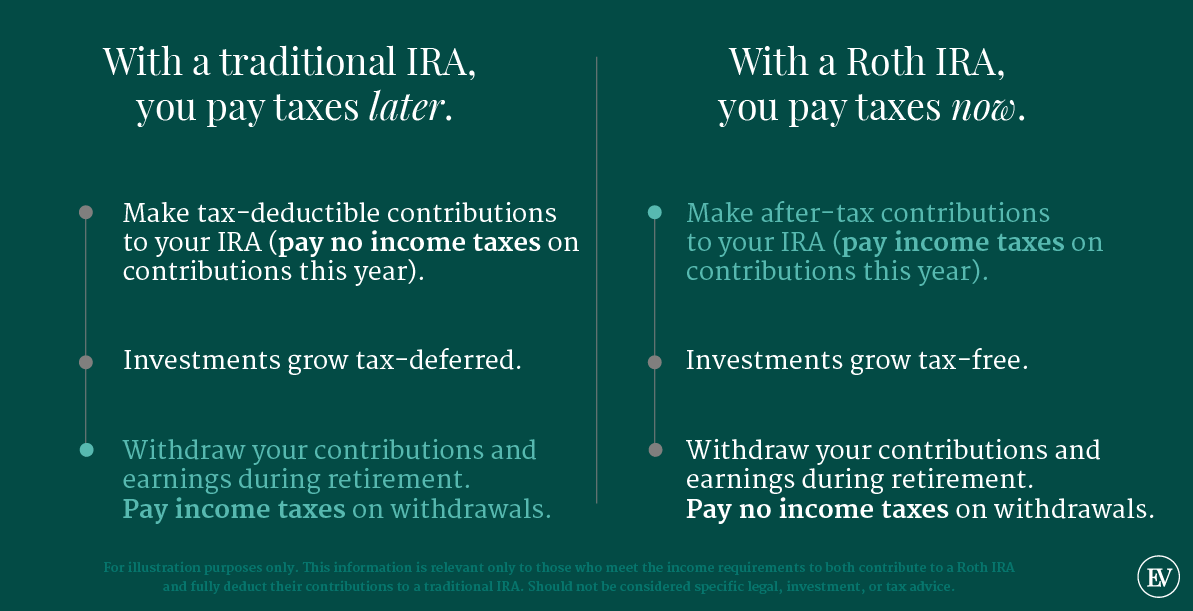

Contributing to an IRA. Money deposited in a traditional IRA is taxed differently from money in a Roth. Any early IRA withdrawal is.

Traditional IRAs are tax-deferred funds. Yes you can make a tax payment using IRS Form 1040-ES Estimated Tax for Individuals. What if you want to withdraw money from a traditional IRA before age 59½.

A traditional IRA is funded with pre-tax dollars. However you will owe no taxes on the contributions or the investment. Deferring taxes means all of your dividends interest.

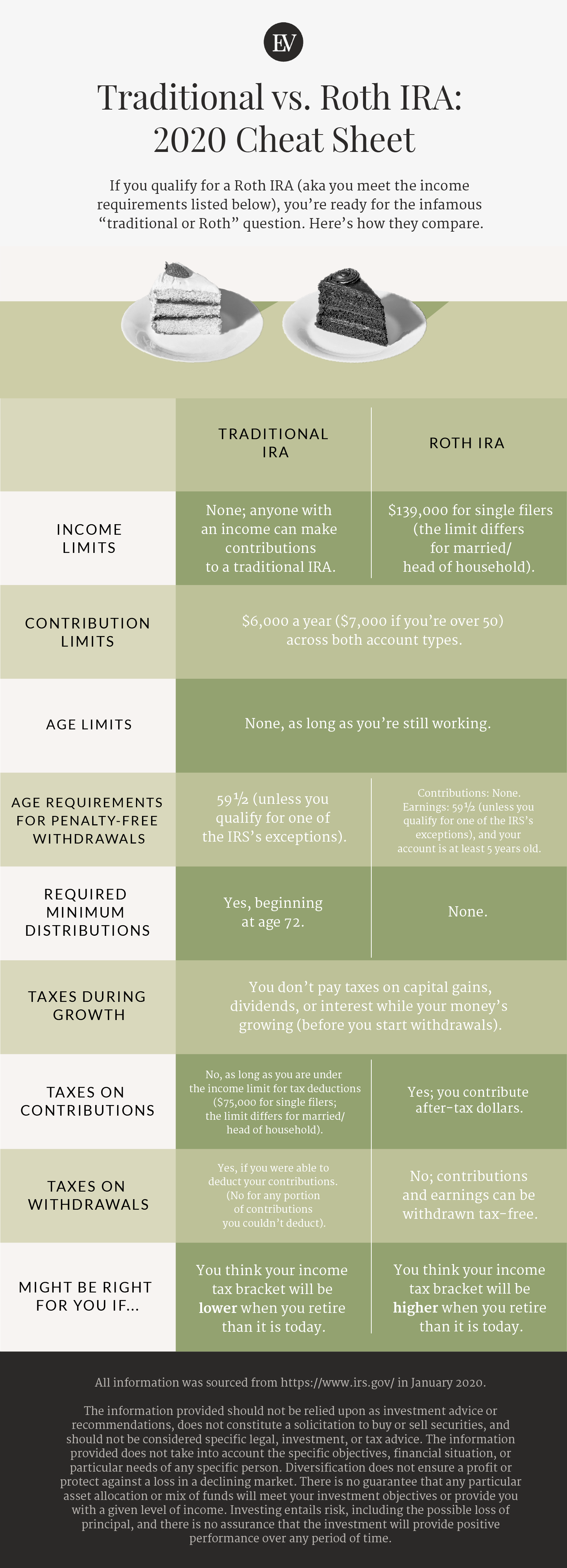

Generally amounts in your traditional IRA including earnings and gains are not taxed until you take a distribution withdrawal from your IRA. On the other hand the Roth IRA is the opposite. You can start taking distributions from your IRA without paying a tax penalty when you reach age 59½ but the amount you withdraw may be subject to income taxes depending on the type of IRA.

Updated April 08 2021. While your money will grow tax-free in both types of IRAs. If you withdraw money from your traditional IRA before you turn age 59 12 youll owe ordinary income taxes on that amount and a 10 percent tax penalty.

You pay taxes on your money only when you make withdrawals in retirement. You get to write off deposits but you pay income tax when you make withdrawals. With a traditional IRA.

A traditional IRA is a tax-deferred retirement savings account. And in the case of a traditional IRA UBTI results in double taxation because you have to pay tax on the UBTI in the year it occurs and taxes when you take a distribution. As soon as you start taking withdrawals you will pay income tax on the money.

Publication 590-A and Publication 590-B explain the details of IRAs including. With most traditional IRAs the tax consequences are simple. With a Roth IRA you have to pay taxes when you withdraw earnings under.

The IRS levies taxes on a traditional IRA when you withdraw your retirement money. Transferring money or property to and from an IRA. Say you convert during the first quarter of.

The RMD is the minimum amount an IRA stakeholder. In general early withdrawalsbefore age 59½from any type of qualified retirement account such as IRAs and 401 k plans come with a 10. Penalties Fees and Taxes on IRA Withdrawals.

You do not any taxes on the contributions or the interest they earn until you begin taking withdrawals during retirement. If you withdraw money from your traditional IRA before you reach age 59 12. Each dollar you deposit reduces your taxable income by.

Make sure that any IRA withdrawals you do make are above the annual required minimum distribution RMD. Basically Uncle Sam wants your taxes paid as you earn or receive your income during the year. The IRS will waive the early distribution penalty in certain cases such as if you become disabled or use up to 10000 to pay for a first home.

If you take those distributions before you reach the age of 595 youll likely have to pay a 10 early withdrawal penalty fee to the IRS. Your annual distributions are included in. You can do it but youll pay a fairly high penalty.

An excellent feature of Roth IRAs is that when the time comes retirement money. You pay the full income taxes on the money you pay into the account. If you convert a substantial traditional IRA to a Roth IRA early in the year your quarterly incomeand therefore your quarterly taxeswill increase.

Youll have to pay taxes on any distributions taken out of the account at current income tax rates. A contribution to a Roth IRA is not tax-deductible. Setting up an IRA.

You contribute pretax income.

Chapter 2 What Is The Difference Between Traditional Ira And Roth Ira Moneycounts A Penn State Financial Literacy Series

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Roth Vs Traditional Ira What You Need To Know Ellevest

Roth Vs Traditional Ira What You Need To Know Ellevest

Traditional Ira Definition Rules And Options Nerdwallet

Traditional Ira Definition Rules And Options Nerdwallet

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg) Roth Ira Withdrawals Read This First

Roth Ira Withdrawals Read This First

Am I Too Old To Start An Ira Financial Stress

Am I Too Old To Start An Ira Financial Stress

Roth Ira Vs Traditional Ira Which One Is Better My Money Design

Roth Ira Vs Traditional Ira Which One Is Better My Money Design

Roth Vs Traditional Ira What You Need To Know Ellevest

Roth Vs Traditional Ira What You Need To Know Ellevest

Roth Ira Or Traditional Ira Or 401 K Fidelity

Roth Ira Or Traditional Ira Or 401 K Fidelity

Isolating Ira Basis For More Tax Efficient Roth Ira Conversions Financial Planning

Isolating Ira Basis For More Tax Efficient Roth Ira Conversions Financial Planning

/Takingmoneyoutofanira-98057a4d86a843f99b9141cd5c111009.png)

Comments

Post a Comment