- Get link

- X

- Other Apps

Retirement at age 62 affords you the freedom to do whatever you want while youre still healthy enough to enjoy it. Reasons to Think Should You Retire at 62 When you think about it there are some really good reasons to retire at 62.

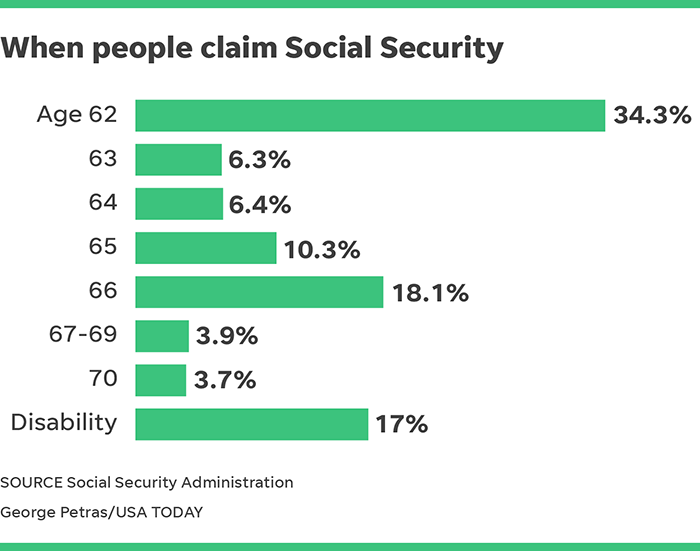

What S The Most Popular Age To Take Social Security

What S The Most Popular Age To Take Social Security

During the year in which you reach full retirement age the SSA will deduct 1 for every 3 you.

If you retire at 62. Try the simple retirement calculator. You can delay retirement until youre 70 years old which is past your full retirement age. For example if you were born in 1960 or later your FRA is 67 and retiring at 62 means that there are 60 months between the time you filed and the time at which you would have been eligible for your full retirement benefit.

Claiming Social Security at 62 means subjecting yourself to the maximum reduction in benefits you can face. According to the rules of the Social Security Administration you are allowed to retire and claim benefits at the age of 62. The exception to this rule is beneficiaries who have a disability.

Your FIN tells you how much you need to generate enough income in retirement. So is retiring at 62 a good idea. But you have to plan.

The reduction for filing 60 months early is 59 of 1 x 36 512 of 1 x 24 which works out to a 30 reduction. 59 of 1 for each month before the FRA up to 36 months. Men retire at an average age of 64 while for women the average retirement age is 62.

If your FRA is 66 filing at 62 will constitute a 25 hit to your benefits. For example if you were born in 1956 and you decide to begin receiving benefits exactly at age 62 this year then youll collect 733 of the amount youd collect at full retirement age. In 2020 the yearly limit is 18240.

Can I retire at age 62 with 700000. We know that 62 is 5 years 60 months prior to your full retirement age. Retiring at any age means you have become financially independent and are able to generate enough passive income to support yourself reliably.

In many cases it is better to find other sources of funds to finance your early retirement so that you can delay the start of your Social Security benefits. You cant receive Social Security retirement benefits until you reach the age of 62 so working and receiving benefits isnt possible until you reach that age. If you live to the average life expectancy you should expect to receive about the same total benefit either whether you opt to take early benefits or delay.

Current Savings Annual Deposits Annual Withdrawals Stock market crash Portfolio. 62 is the first year youre eligible for Social Security but your benefit amount will lower. AARPs Social Security Benefits Calculator can provide more details on how filing early reduces benefits.

When you reach your late 40s or early 50s its natural to start wondering whether you could retire in the next decade. By filing at 62 or any time before you reach full retirement age you forfeit a portion of your monthly benefit. But as you probably already know just because you may do something doesnt necessarily mean you should do it.

Even if you retire early be careful about taking your Social Security benefits at age 62 without doing an analysis first. 1 So whether its traveling taking up new hobbies or simply finding a part-time job with less stress its. Each year Social Security sends you a statement that shows your expected benefit at age 62 at full retirement age and at age 70.

You should consider retiring if youre financially prepared and ready to explore the next chapter of life. Your 62nd birthday has just arrived and with it came an overwhelming temptation to retire. About Your Retirement.

The calculator tells you that your retirement benefit at 62 would be 1000. If you have 225000 saved the answer is. This can help protect you from running out of money later in life.

According to payout statistics from the Social Security Administration in June 2020 the average Social Security benefit at age 62 is 113016 a month or. Use the below retirement simulation to view the chances of a successful retirement. If you retire at 62 youll need to make sure you can afford adequate health insurance coverage until age 65 when your Medicare benefits begin.

The penalty for early retirement reduces the benefit amount by. 10 rows You can start receiving your Social Security retirement benefits as early as age 62. The key to knowing when if you can retire at 62 with 300k is knowing your Financial Independence Number FIN.

How much can you earn in 2020 and draw Social Security at 62. If you were born in 1960 or later for instance filing at 62 could reduce your monthly payment by as much as 30 percent.

University Of California Should You Take Social Security At 62

University Of California Should You Take Social Security At 62

Please Don T Retire At 62 Here S Why

Please Don T Retire At 62 Here S Why

How Much Money Do I Need To Save To Retire At 62 Goodlife

How Much Money Do I Need To Save To Retire At 62 Goodlife

How Much Money Do I Need To Save To Retire At 62 Goodlife

How Much Money Do I Need To Save To Retire At 62 Goodlife

/social-security-retirement-benefits-while-working-2894597-v1-1cd7c45096a24f059e87116a5c8e6326.png) Social Security Retirement Benefits While Working

Social Security Retirement Benefits While Working

Early Retirement Age Is It Possible To Retire At 62 Bankrate Com

Early Retirement Age Is It Possible To Retire At 62 Bankrate Com

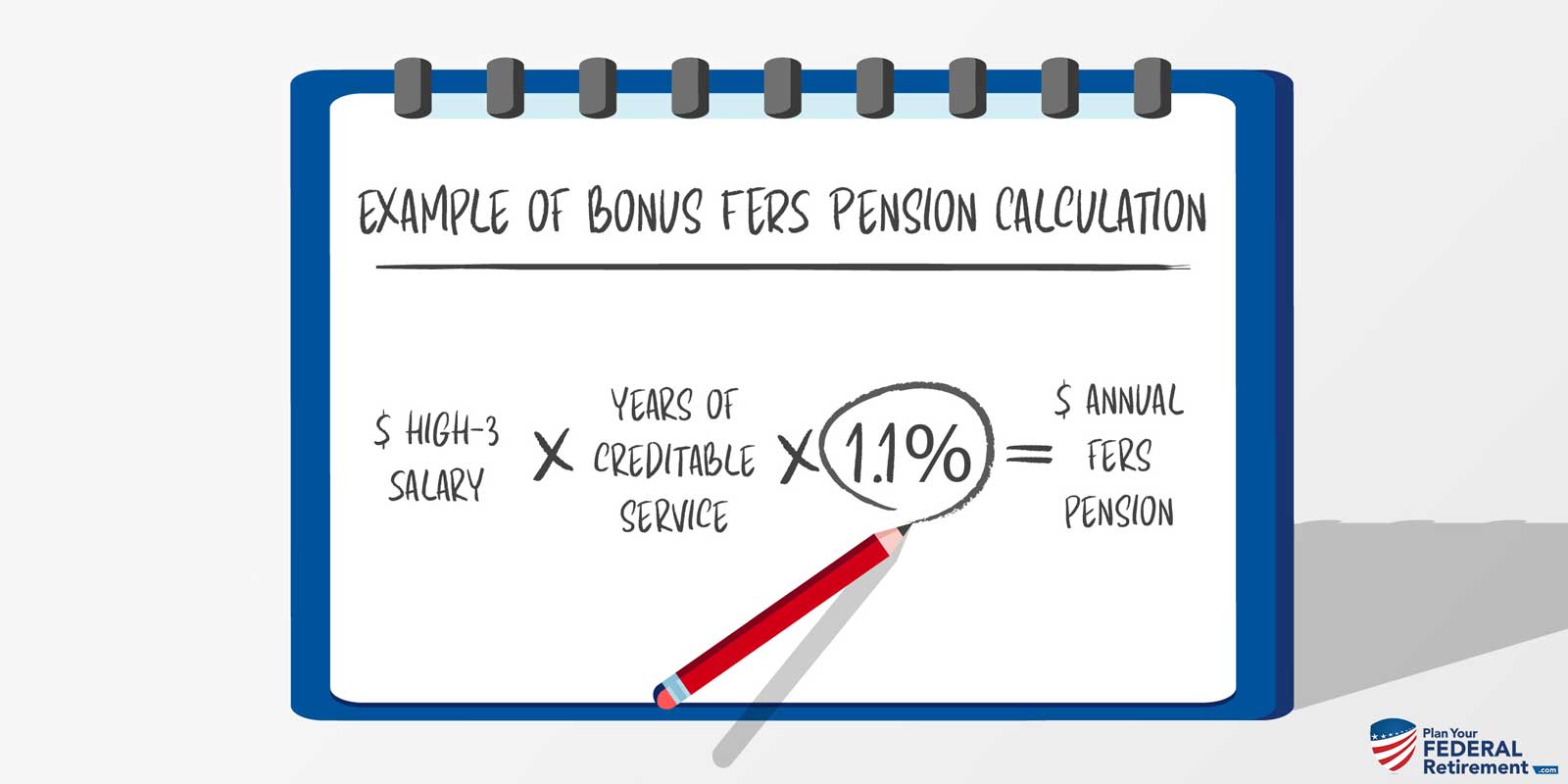

Fers Retirement Special 10 Bonus Age 62 With 20 Years Of Service

Fers Retirement Special 10 Bonus Age 62 With 20 Years Of Service

10 Reasons Why You Should Actually Retire At 62 If You Can

10 Reasons Why You Should Actually Retire At 62 If You Can

If I Retire At 62 This Year How Much Will I Collect In Social Security Social Security Retirement Advice Retirement

If I Retire At 62 This Year How Much Will I Collect In Social Security Social Security Retirement Advice Retirement

Can I Retire At 60 With 500k Or Maybe At 55

Can I Retire At 60 With 500k Or Maybe At 55

Full Retirement Age For Getting Social Security The Motley Fool

Full Retirement Age For Getting Social Security The Motley Fool

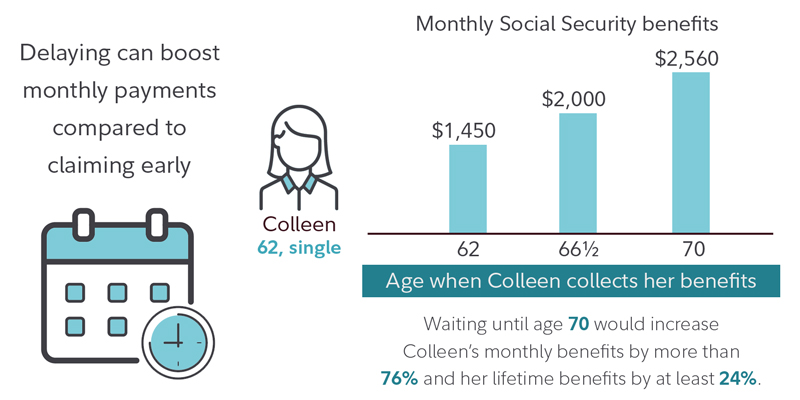

Social Security At 62 Fidelity

Social Security At 62 Fidelity

When Should You Take Social Security Charles Schwab

When Should You Take Social Security Charles Schwab

How Much Money Do I Need To Save To Retire At 62 Goodlife

How Much Money Do I Need To Save To Retire At 62 Goodlife

Comments

Post a Comment