- Get link

- X

- Other Apps

Its fairly common for survivors to believe that theyre on the hook for a deceased family. In reality credit card debt you left unpaid does not go away.

Credit Card Debt Metro Detroit Bankruptcy Law Group

Simply ignoring it would actually lead you to more trouble--you will have to pay interest charges and late fees on top of the loan balance that you have.

Does credit card debt go away. The answer may surprise you. Basically the rule says that medical debts expire after seven years which isnt true at all. The actual debt doesnt get erased after seven years particularly if its unpaid.

The credit issuers dont just walk away they go after the funds through the estate of the deceased or any joint cardholders. You may worry about who is responsible for repaying the debt or if the loan will be forgiven upon your death. This urban myth probably arose from two factors.

Credit card companies sell your delinquent account to collection agencies which continue calling you more. The creditors write off your account as a financial loss to the company but that doesnt let you off the hook. Your credit report if youre not familiar is a document that lists your credit and loan accounts and payment histories with various banks and other financial institutions.

It will take some time find a new job pay back what you owe. No debt ever is. You will haver to try and manage all your accounts and budget so that you can make payments on the cards.

Unfortunately credit card debts do not disappear when you die. Debt can remain on your credit reports for about seven years and it typically has a negative impact on your credit scores. The debt never actually expires there is no rule or law that forces a debt to expire after a certain period of time.

A primary reason many people file for Chapter 7 bankruptcy is to discharge wipe out credit card debt. The debt doesnt go away but should be paid along with other debts by the cardholders estate before heirs get anything unless there is not enough money to. You will always owe it.

Which case property is confiscated as well as a portion of your paycheck until it is paid off. Credit card debt cannot go away as such. Credit card debt typically isnt passed on to relatives after death but there are exceptions to this rule.

They wipe them from their books and take the losses for tax purposes. However a creditor has a limited time in which to sue you for the debt called the statute of limitations. Death is one of those unpleasant certainties in life.

It takes time to make that. The statute of limitations and the amount of time seven years that a debt will stay on your credit report. We need our credit cards at this time Will you go to jail when you cant pay your credit card debt.

75 years to be exact more on that later This law only governs how long the information can remain on your credit report. After a certain time -- 90 days or more depending on the creditor -- the credit card companies charge off your debt. There is no statute of limitations on credit card debt until you get sued by creditors and the judge orders you to pay it.

The Bill of Rights Art. An increasing number of charged-off cards occurred after the 2008 financial crisis for a. Unfortunately its just not that simple.

But quite often it isnt. Also you screw up you credit rating so you wont be able to rent a. Credit card companies will eventually write off debts they cannot collect from some consumers after about 60 to 90 days.

The short answer to this question is No. You will have to pay off the credit card debt so that the debt goes off. In most situations your obligation to pay the balance will go away at the end of your case--except in instances of fraud that is.

Your estate which includes everything you own your car home bank accounts investments to name. Lets take a look at how this process works and what the family can expect after losing a loved one with credit card debt. 20 of the 1987 Charter expressly states that No person shall be imprisoned for debt This is true for credit card debts as well as other personal debts.

With credit card debt you may have additional anxiety about how debts are handled after your death. It has nothing to do with the liability you have on the debt. Credit card debt does not go away on its own just like that.

A common misconception exists that credit card debt you owe disappears after seven years when it disappears off of your credit report. Credit card debt does not instantly vanish upon death. Its possible that left-behind credit card debt could be your responsibility.

4 Simple Steps To Get Out Of Credit Card Debt

4 Simple Steps To Get Out Of Credit Card Debt

How To Get Out Of Credit Card Debt Real Simple

How To Get Out Of Credit Card Debt Real Simple

Consolidate Credit Card Debt With A Personal Loan Earnest

Consolidate Credit Card Debt With A Personal Loan Earnest

How To Eliminate Credit Card Debt In 3 Easy Steps Nev Harris

How To Eliminate Credit Card Debt In 3 Easy Steps Nev Harris

Debt Snowball Vs Debt Avalanche Paying Credit Card Debt Forbes Advisor

Debt Snowball Vs Debt Avalanche Paying Credit Card Debt Forbes Advisor

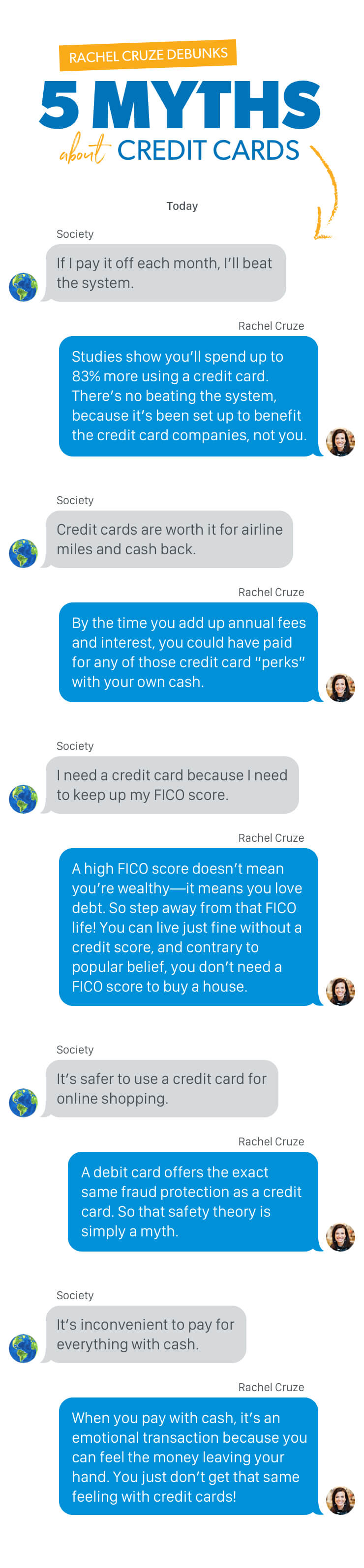

Your Top Credit Card Debt Questions Answered Ramseysolutions Com

Your Top Credit Card Debt Questions Answered Ramseysolutions Com

Average Credit Card Debt Statistics Updated September 2020

Average Credit Card Debt Statistics Updated September 2020

What A Relief Get Out Of Your Credit Card Debt With These Tips Zing Blog By Quicken Loans

Credit Card Debt How To Pay Off This Is How I Paid Off 5 500 Worth Of Credit Card Debt During The Pandemic

Credit Card Debt How To Pay Off This Is How I Paid Off 5 500 Worth Of Credit Card Debt During The Pandemic

Signs You Have Too Much Credit Card Debt

Signs You Have Too Much Credit Card Debt

How Much Credit Card Debt Is Too Much Rinkydoo Finance

How Much Credit Card Debt Is Too Much Rinkydoo Finance

What S The Best Way To Manage Credit Card Debt Here Are 12 Self

What S The Best Way To Manage Credit Card Debt Here Are 12 Self

:max_bytes(150000):strip_icc()/exhausted-businessman-running-away-from-credit-card-170886185-5770a3ff3df78cb62ce6521c.jpg) Ways To Avoid Credit Card Debt

Ways To Avoid Credit Card Debt

Comments

Post a Comment