- Get link

- X

- Other Apps

Get Results from multiple Engines. This temporary schedule change will be in place until further notice.

Ny 529 College Savings Program Digital Out Of Home Advertising All Points Media

New Yorks 529 College Savings Program Direct Plan education savings specialists are available to provide assistance Monday through Friday from 8 am.

College 529 ny. Get Results from multiple Engines. The New York 529 College Savings Program stands out for its low fees and transparency. NYs 529 College Savings Program Direct Plan.

For more information about New Yorks 529 College Savings Program Direct Plan download a Disclosure Booklet and Tuition Savings Agreement or request one by calling 877-NYSAVES 877-697-2837. To 8 pm Eastern time. Ad Search For Relevant Info Results.

Take a closer look at how to pay for college using a tax-favored savings option such as a 529 plan with the College Savings Planner from Vanguard manager of NYs 529 College Savings Program direct plan. Any account holder can enjoy several tax benefits but New York families can deduct up to 10000 from their state taxable income. You should read and consider them carefully before investing.

Direct this 529 plan can be purchased directly through the state. Visit NYs 529 College Savings Plan website to learn more. New Yorks 529 College Savings Program Direct Plan education savings specialists are available to provide assistance Monday through Friday from 8 am.

Contributions to New York 529 plans are made with after-tax dollars. 63 rows New York. This document includes investment objectives risks charges expenses and other information.

After a 1000 initial minimum contribution amount for advisor-sold New York 529 plans subsequent contributions must be at least 25. Tax Deductions for New York 529 Plan Contributions. Ad Search For Relevant Info Results.

Learn more though the programs frequently asked questions. New Yorks 529 Advisor-Guided College Savings Program is a college savings plan sponsored by the State of New York that provides a tax-advantaged way for. Through NYs 529 College Savings Program you can save on taxes while you save for college.

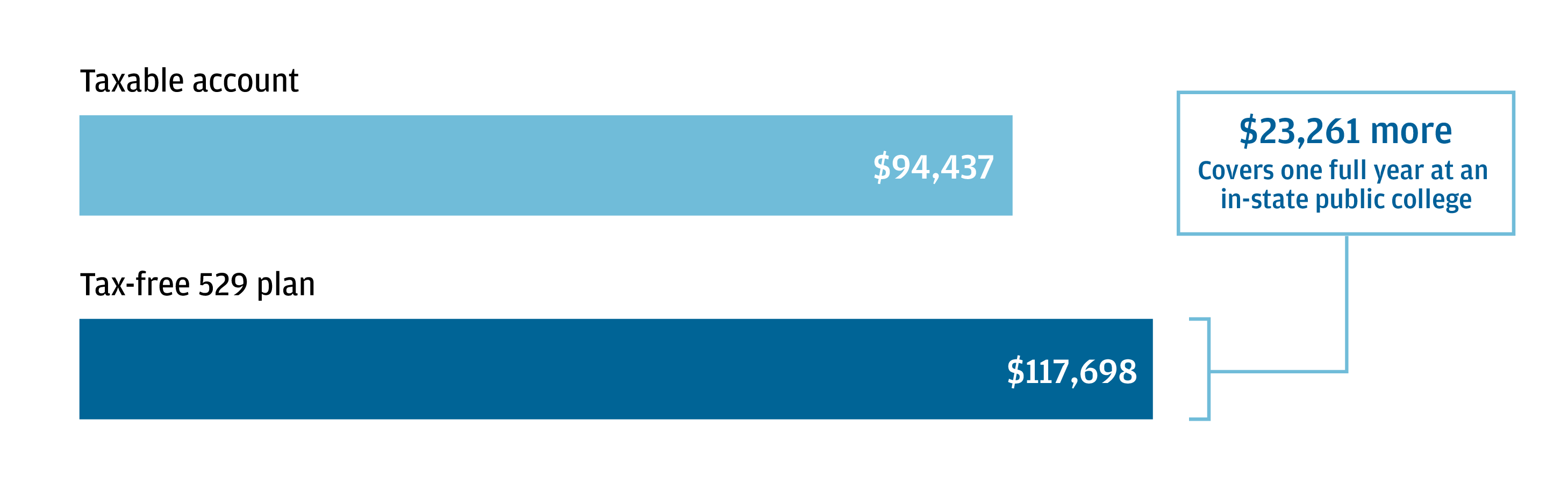

529 plans offer tax-advantaged ways to save money because investments made in these accounts grow tax-free and all withdrawals used for qualified higher education expenses are exempt from federal income tax. This temporary schedule change will be in place until further notice. For more information about New Yorks 529 College Savings Program Direct Plan download a Disclosure Booklet and Tuition Savings Agreement or request one by calling 877-NYSAVES 877-697-2837.

If you live in New York and are planning to put a child through college you can receive a substantial tax deduction by contributing to New Yorks 529 College Savings Program. To 8 pm Eastern time. There is no minimum contribution amount for the direct-sold New York 529 plan.

Learn who administers the NYSAVES Direct Plan and Advisor Plan. 1 Earnings on nonqualified withdrawals may be subject to federal income tax and a 10 federal penalty tax as well as state and local income tax. New Yorks 529 College Savings Program is a traditional 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education expenses.

If the taxpayer made contributions as the account owner to one or more tuition savings accounts established under the New York State 529 College Savings Program then include contributions up to 5000 10000 for married filing joint on Line 30 of the NY Form IT-201 line 29 of the IT-203 in the Federal amount column only New Yorks 529 College Savings Program. The total asset-based fee was recently reduced to 013 for each portfolio. You should read and consider them carefully before investing.

This document includes investment objectives risks charges expenses and other information.

Ny S 529 College Savings Program Ny 529 Direct Plan

Ny S 529 College Savings Program Ny 529 Direct Plan

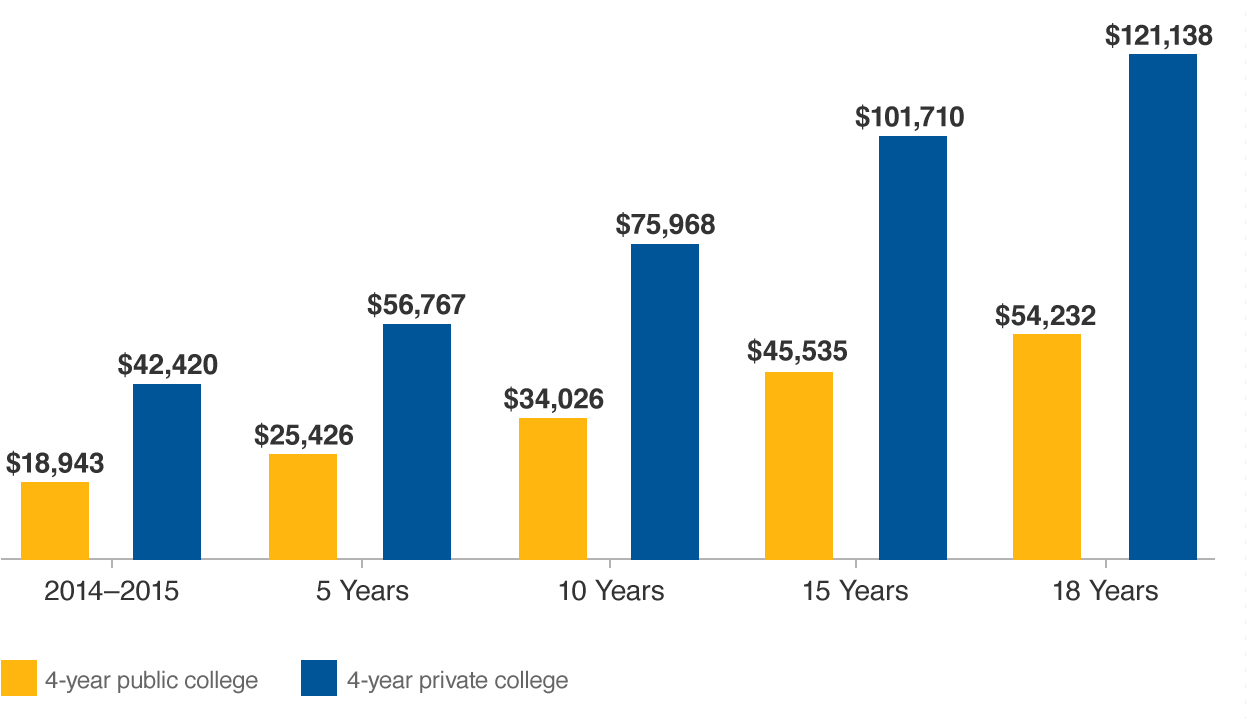

Cost Of College Ny 529 Direct Plan

Cost Of College Ny 529 Direct Plan

529 College Plans Are Hit By Stock Market Turmoil The New York Times

529 College Plans Are Hit By Stock Market Turmoil The New York Times

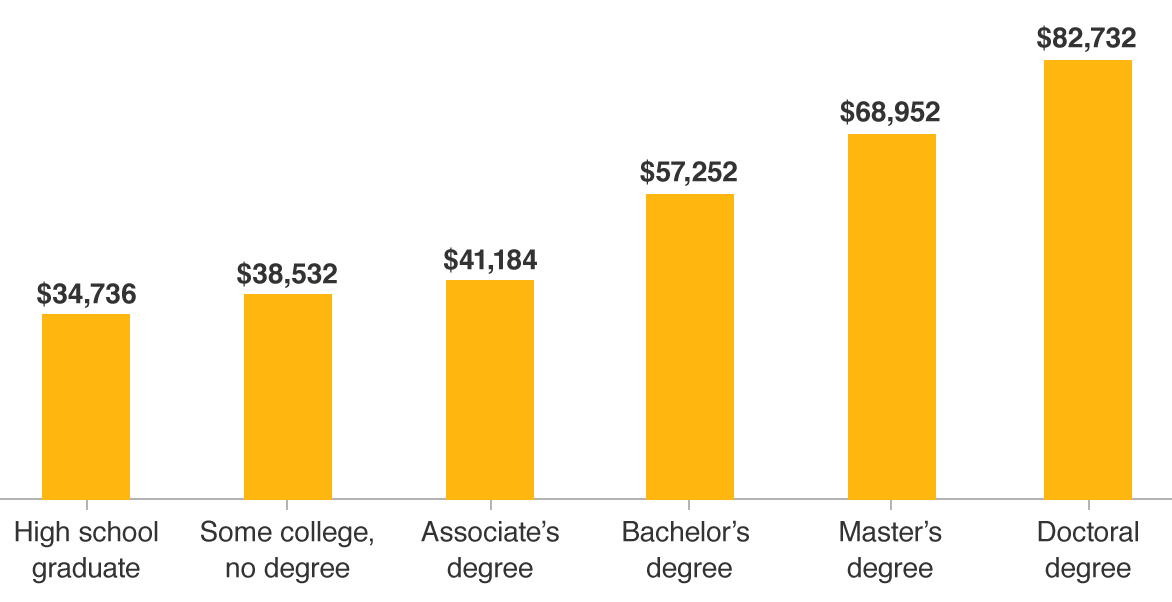

Start Early To Prepare Your Child For College Ny 529 Direct Plan

Start Early To Prepare Your Child For College Ny 529 Direct Plan

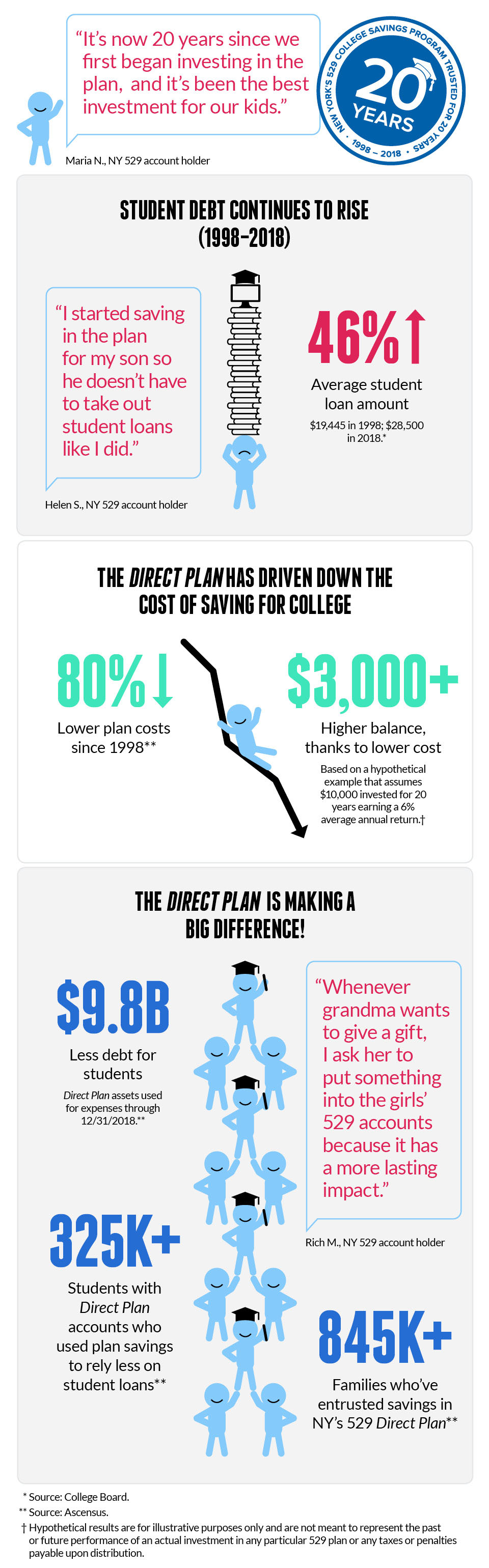

More Saving Less Borrowing With Ny 529 Direct College Savings Plan Ny529edu New Mommy Bliss

More Saving Less Borrowing With Ny 529 Direct College Savings Plan Ny529edu New Mommy Bliss

Cheapscholar Orgnow Is The Time To Save For College In New York Cheapscholar Org

Savings Tips And Strategies Ny529 Advisor

Savings Tips And Strategies Ny529 Advisor

Saving For College With A Ny 529 Plan Marinobambinos

Saving For College With A Ny 529 Plan Marinobambinos

New York Ny 529 College Savings Plans Saving For College

New York Ny 529 College Savings Plans Saving For College

529 Plan Tax Benefits J P Morgan Asset Management

529 Plan Tax Benefits J P Morgan Asset Management

New York S 529 College Savings Named Official College Savings Partner Of New York City Fc New York City Fc

New York S 529 College Savings Named Official College Savings Partner Of New York City Fc New York City Fc

New York S 529 College Savings Program Direct Plan New York 529 College Savings Plan Ratings Tax Benefits Fees And Performance

New York S 529 College Savings Program Direct Plan New York 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Comments

Post a Comment