- Get link

- X

- Other Apps

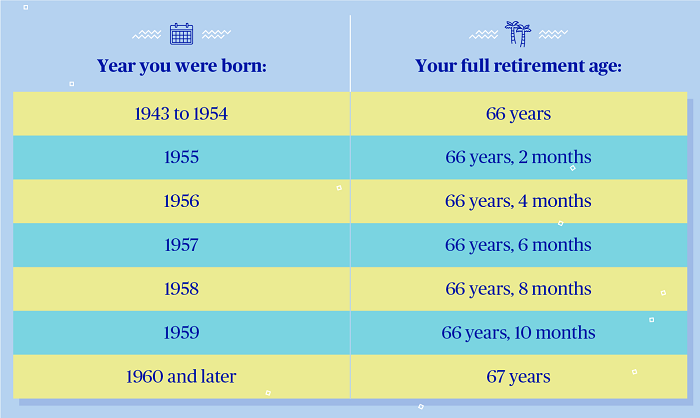

Moreover benefits are based partially on your pre-retirement income level which may fluctuate during your lifetime. Those born after 1960 qualify for full benefits.

Your Social Security Statement Is Now At Your Fingertips Social Security Matterssocial Security Matters

Your Social Security Statement Is Now At Your Fingertips Social Security Matterssocial Security Matters

Results are based on your current earnings and birthdate.

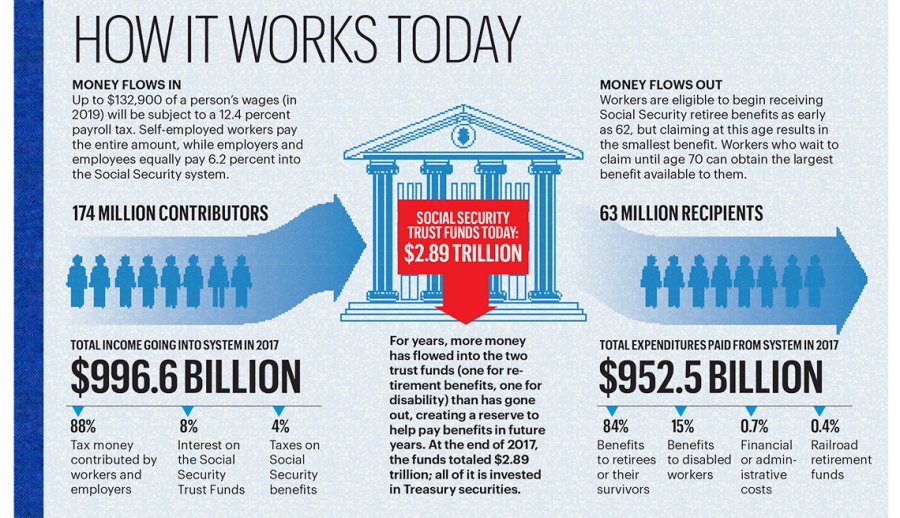

What is your social security based on. You receive Social Security benefits based on the amount of Social Security taxes you have paid which up to a certain maximum amount is based on your income. But Social Security also pays a disproportionate amount to people earning low incomes. All retirees can start collecting reduced benefits at age 62.

Confusingly though the formula is based on the year when you first become eligible for Social Security. This changed in 1972 when the Social Security Administration began issuing SSNs from its Baltimore headquarters and assigning area numbers based on the applicants mailing address. Social Security benefits automatically increase each year based on increases in.

The total withholding for FICA taxes is 153 of the employees gross pay. We apply a formula to this average to compute the primary insurance amount PIA. For retirement benefits the number of computation years always equals 35 and these computation years are the only ones used when calculating your Social Security benefit.

We adjust or index your actual earnings to account for changes in average wages since the year the earnings were received. That said if you are curious how much you might receive from Social Security the government offers a quick calculator that will give you a rough estimate. The maximum possible Social Security benefit for someone who retires at.

The figure is adjusted annually based on changes in national wage levels and thus the maximum benefit changes each year. My social security election age. Many people wonder how we figure their Social Security retirement benefit.

Social Security benefits are typically computed using average indexed monthly earnings This average summarizes up to 35 years of a workers indexed earnings. Your FRA can vary depending on the year you were born. People who have had greater incomes tend to get greater Social Security benefits.

The gross pay amount is also used to calculate withholding for Social Security and Medicare taxes. Your monthly retirement benefit is based on your highest 35 years of salary history. The average Social Security benefit was 1543 per month in January 2021.

Anyone who applied for a social security number between 1972 and 2011 will have an area number that correlates to the mailing address listed on their. The Social Security Administration will take all of your historical earnings and index them up for inflation and then theyll take out a certain number of computation years. The concept of social security is based on ideals of human dignity and social justice.

For those who first become eligible for Social Security in 2018 the. The gross pay amount is used to calculate withholding for federal and state income taxes based on the employees W-4 form. Your Social Security benefits will be based on the income you earned during your working years.

For people born between 1943 and 1954 as in our example the FRA is age 66. You will receive 40982 in annual social security payments starting at age 66. Social Security is based on a sliding scale depending on your income how long you work and at what age you retire.

The more money you earned the more you paid. The most traditional form of Social Security retirement benefits are based on age. For people born on Jan.

Thats the most a family can collectively receive from Social Security including retirement spousal childrens disability or. The annual payment you receive from Social Security is based on your income birth year and the age at which you elect to begin receiving benefits. You can get your earnings history from the Social Security Administration SSA.

Someone born on Jan. 1 1955 will have an FRA based on 1954. Your Social Security benefit also depends on how old you are when you take it.

Social Security calculates your benefit amount based on your earnings over the years whether you were self-employed or worked for another employer. The underlying idea behind social security measures is that a citizen who has contributed or is likely to contribute to his countrys welfare should be given protection against certain hazards. Only your 35 highest-earning years will be counted.

1 the FRA is based on the year prior. The employee and the employer each contribute half. The maximum benefit is not to be confused with the maximum family benefit.

We base Social Security benefits on your lifetime earnings.

Your Social Security Number The 9 Digit Evolution St Louis Fed

Your Social Security Number The 9 Digit Evolution St Louis Fed

How Does Social Security Work The Motley Fool

How Does Social Security Work The Motley Fool

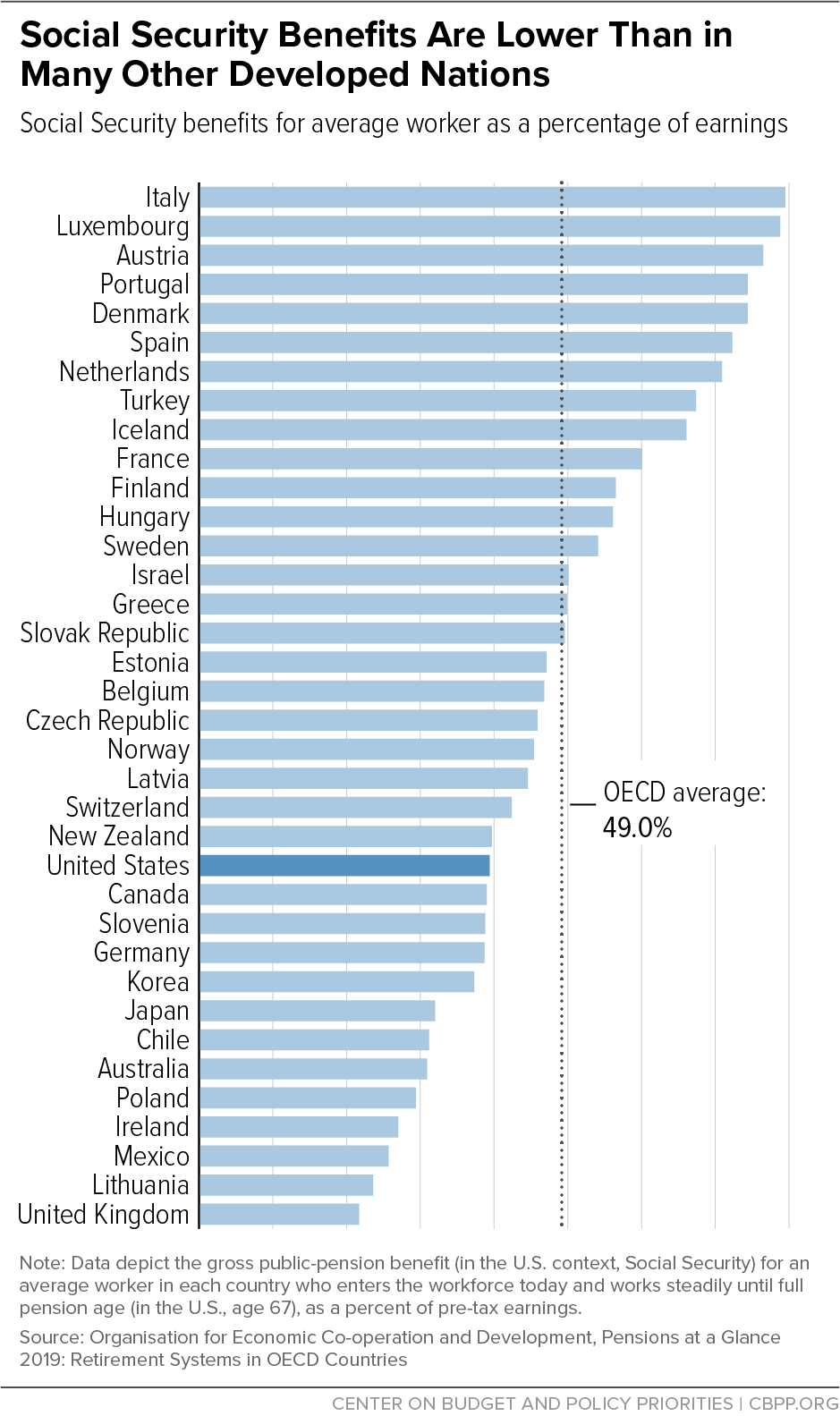

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Social Security Number For Immigrants And Visitors Citizenpath

Social Security Number For Immigrants And Visitors Citizenpath

Social Security 6 Things You Need To Know About Your Statement

Social Security 6 Things You Need To Know About Your Statement

Everything You Need To Know About Social Security Retirement Benefits Simplywise

Everything You Need To Know About Social Security Retirement Benefits Simplywise

Your Social Security Number And Death

/social-security-benefits-calculation-guide-2388927-v3-dbb3bf3dcff4464ba6cf0871518c7059.png) How The Social Security Benefits Calculation Works

How The Social Security Benefits Calculation Works

Your Social Security Statement What It Means And Why It S Important Wiser Women

Your Social Security Statement What It Means And Why It S Important Wiser Women

What Do The Numbers Mean The Social Security Number Howstuffworks

What Do The Numbers Mean The Social Security Number Howstuffworks

A Quick Guide To Social Security Benefits Equitable

A Quick Guide To Social Security Benefits Equitable

Everything You Need To Know About Social Security Retirement Benefits Simplywise

Everything You Need To Know About Social Security Retirement Benefits Simplywise

12 Facts About How Social Security Works

12 Facts About How Social Security Works

/social-security-retirement-benefits-while-working-2894597-v1-1cd7c45096a24f059e87116a5c8e6326.png) Social Security Retirement Benefits While Working

Social Security Retirement Benefits While Working

Comments

Post a Comment