- Get link

- X

- Other Apps

Friday March 19 from 830 am. Make an extension payment.

Total Receipts Office Of The New York State Comptroller

Total Receipts Office Of The New York State Comptroller

103 percent for income between 5 million and 25 million and.

New york tax revenue. File and pay other taxes. Recent data from the New York Department of Taxation and Finance suggest four-year tax revenue losses of 209 billion in real terms about a 67 percent inflation-adjusted decline across the period and a challenge above what the figures would indicate for a state that was struggling to balance its budgets even before the COVID-19 pandemic. Pay a bill or notice.

This table does not include federal tax revenue. In New York two new personal income tax brackets would be temporarily created. Lawmakers are looking to increase taxes on anyone making more than 1 million a year and institute other revenue-generating measures such as creating new tax brackets for.

Metropolitan commuter transportation mobility tax MCTMT Sales tax. Property tax Full list of tax types. Real estate transfer tax.

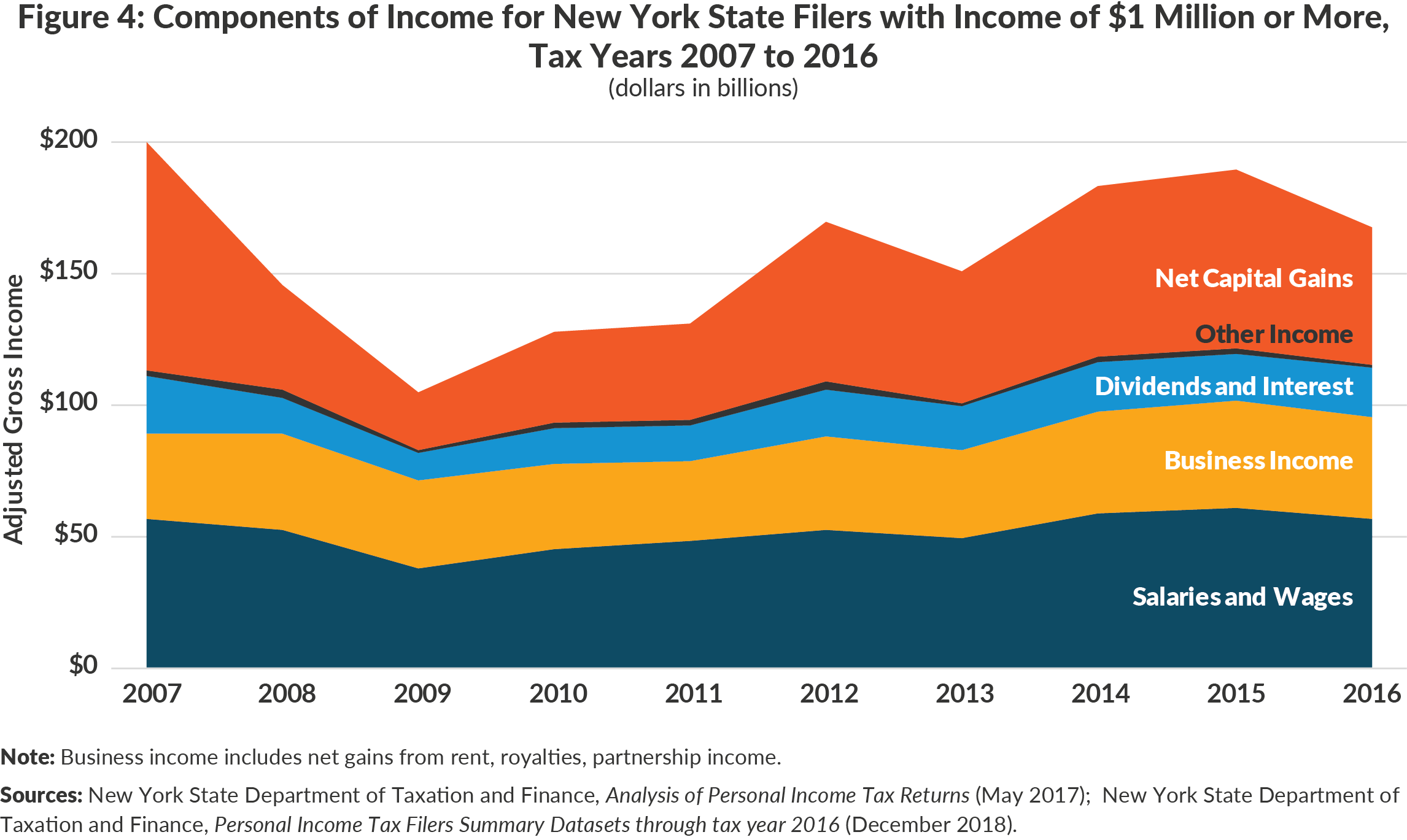

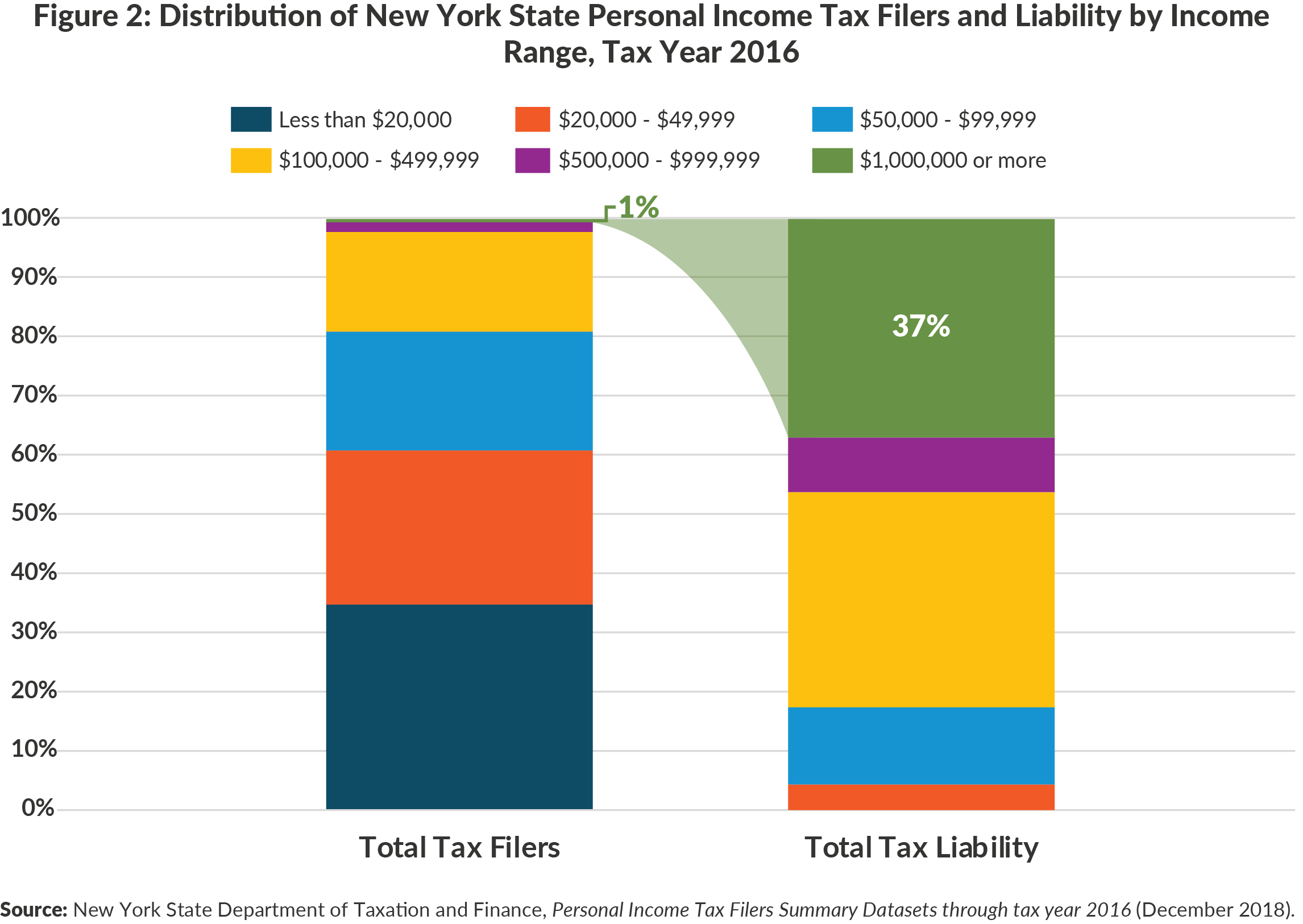

The top 1 of New Yorkers reported a combined 1333 billion in income in 2018 according to new data released last month by the citys Independent Budget Office. The percentage loss in revenue was similar at the upstate Rivers Del Lago and Tioga casinos. New Yorkers earning more than 1 million and couples earning more than 2 million would see the top income tax rate rise from 882 to 985.

Gross Collections indicates the total federal tax revenue collected by the IRS from each US. Make a return payment. New York State Tax.

New York State Tax Revenue Exceeds Latest Estimate by 3 Billion. NYS adjusted gross income is MORE than 107650. Most commonly viewed tax types - Find current year forms by selecting from the list below.

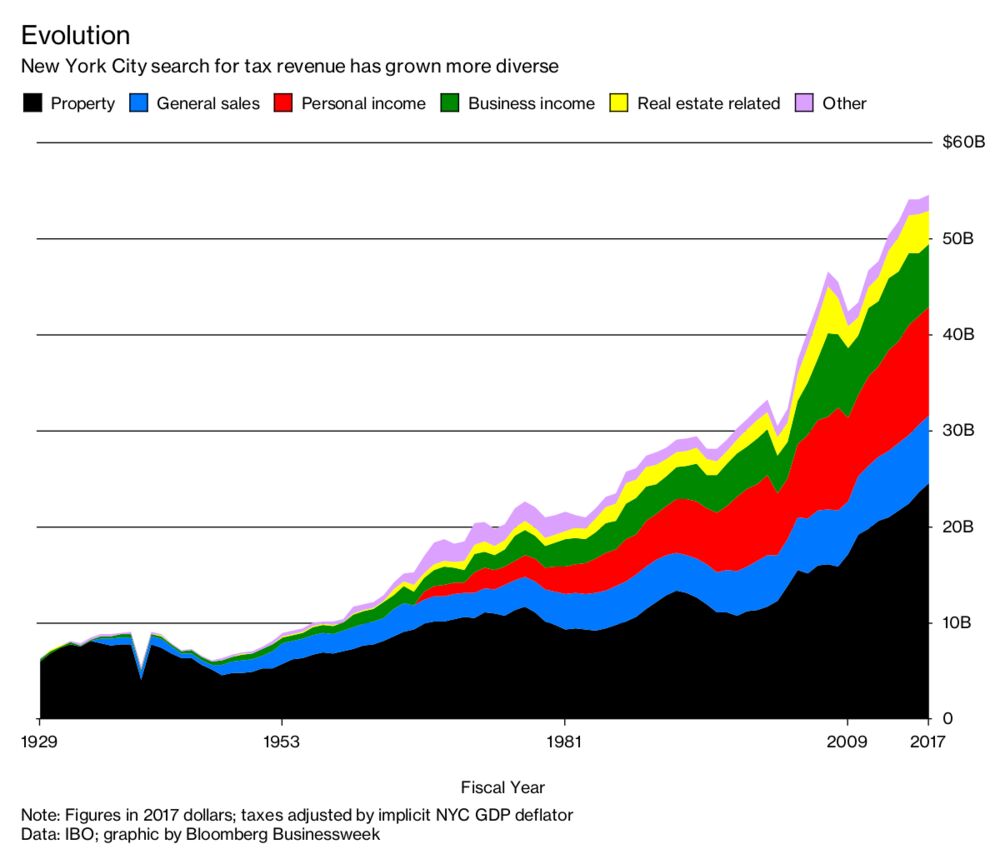

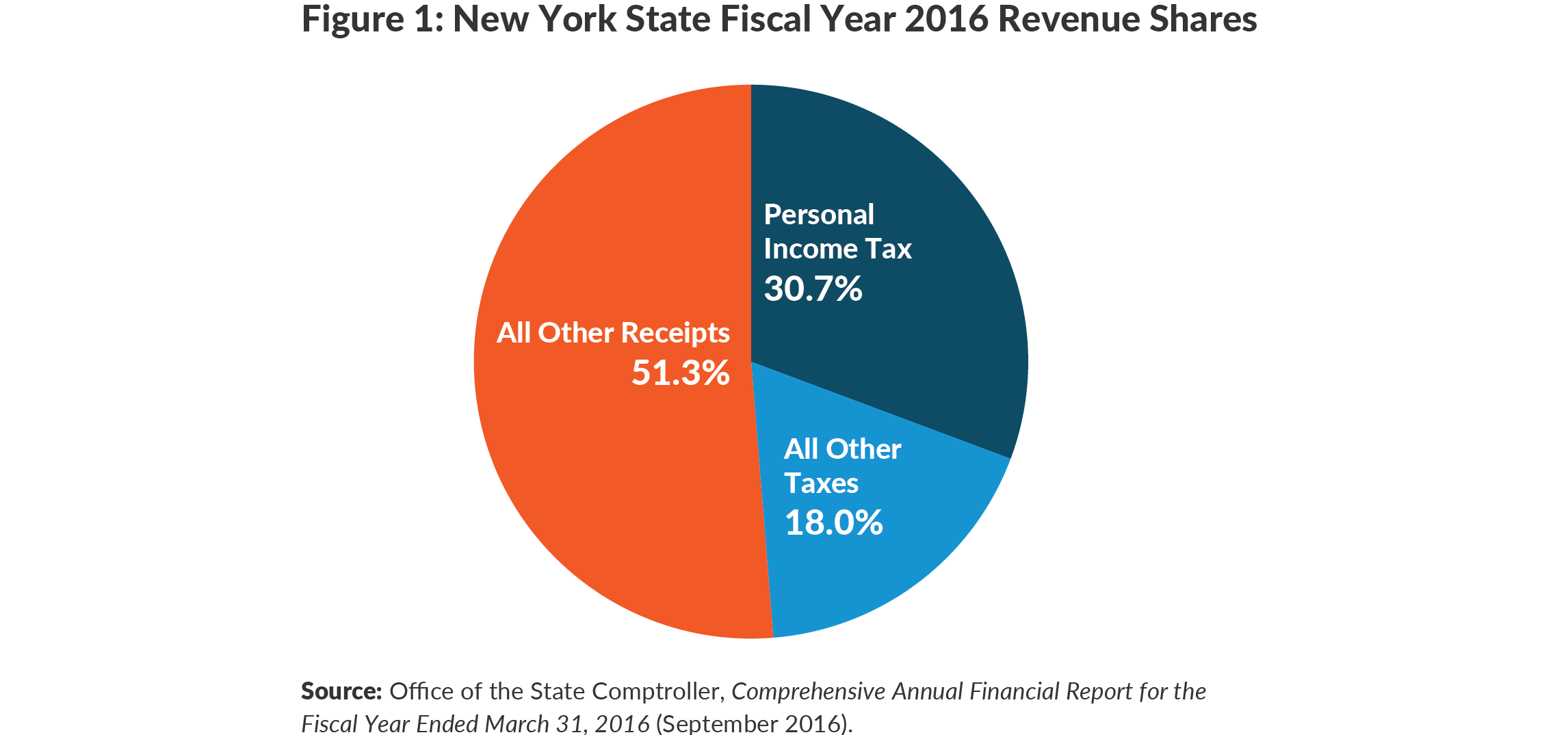

When factoring in the final three months tax revenue will likely be 40 million lower than last year. File Your New York State Income Tax Return Eligible New Yorkers have more free e-file options than ever with brand-name Free File software. In city fiscal year 2016 PIT revenue was 114 billion or 212 percent of total city tax revenue and 138 percent of all revenue.

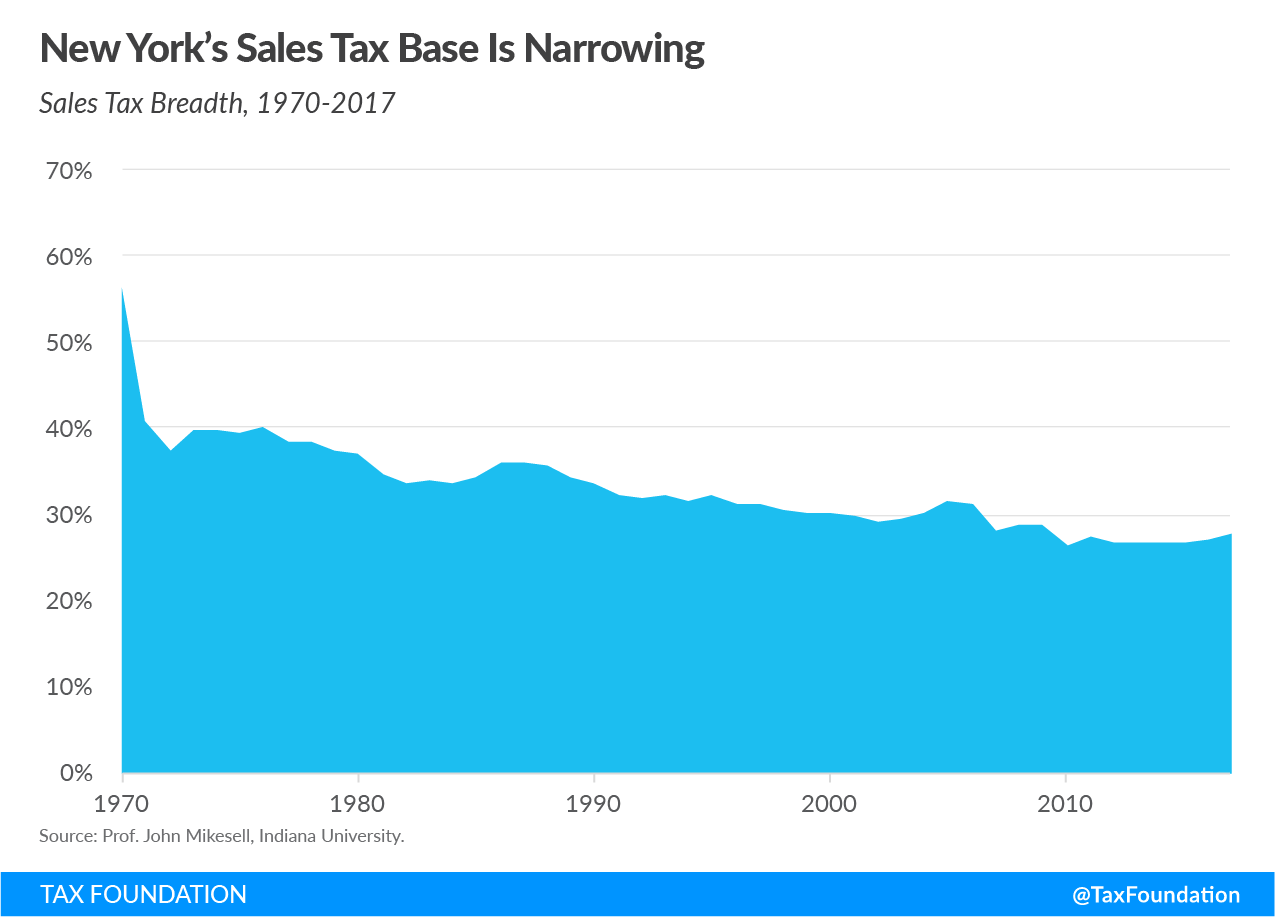

New York City or Yonkers Tax. Local government sales tax collections dropped 10 percent in 2020 according to a press release from the state comptroller. Extended Call Center hours for sales tax.

New York City is less reliant on PIT revenue than the State. Part-year NYC resident tax. Request an installment payment agreement.

NYS adjusted gross income is 107650 or LESS. SAVE TO MY SERVICES SAVED. New York City and Yonkers tax.

Find the forms you need - Choose Current year forms or Past year forms and select By form number or By tax type. AND NYS taxable income is LESS than 65000. In all the state received 824 billion.

Use the NYS tax computation. There will be two new brackets. AND NYS taxable income is 65000 or MORE.

Monday March 22 from 830 am. New York State collected 3 billion more tax revenue in the last fiscal year. State the District of Columbia and Puerto Rico.

Personal income tax receipts were also higher due to higher withholding and lower refunds. Saturday March 20 from 830 am. Our Sales Tax Call Center will be open for additional hours as follows.

The report released by DiNapolis office found revenue in November reached 43 billion which is 525 billion above last year. That comes out to a 18. Metropolitan commuter transportation mobility tax.

Pay a bill or notice. NYS tax rate schedule. This is a table of the total federal tax revenue by state federal district and territory collected by the US.

They paid 49 billion in local. Sales tax returns are due Monday March 22. New York state collected 3 billion more in tax revenue than anticipated during the 2020-21 fiscal year according to Comptroller Thomas DiNapoli.

The figure includes all Individual federal taxes and Corporate Federal Taxes income taxes payroll taxes estate taxes gift taxes and excise taxes.

New York Budget Gap Options For Addressing New York Revenue Shortfall

New York Budget Gap Options For Addressing New York Revenue Shortfall

Taxes Office Of The New York State Comptroller

Taxes Office Of The New York State Comptroller

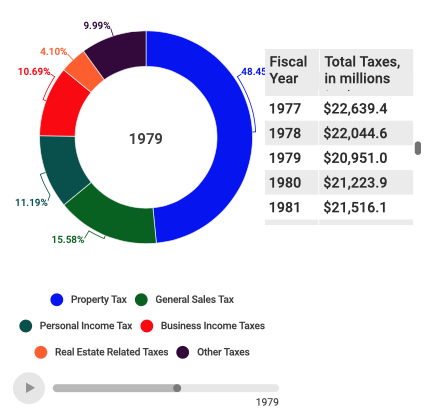

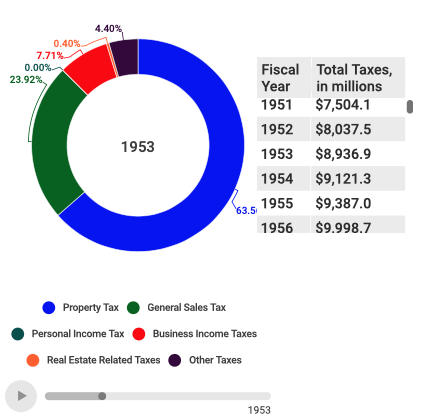

See The Evolution Of Local Tax Revenues In New York City Next City

See The Evolution Of Local Tax Revenues In New York City Next City

New York City Taxes How City Revenue Breaks Down Bloomberg

New York City Taxes How City Revenue Breaks Down Bloomberg

Personal Income Tax Revenues In New York State And City Cbcny

Personal Income Tax Revenues In New York State And City Cbcny

Annual State Of The City S Economy And Finances Office Of The New York City Comptroller Scott M Stringer

Annual State Of The City S Economy And Finances Office Of The New York City Comptroller Scott M Stringer

New York Budget Gap Options For Addressing New York Revenue Shortfall

New York Budget Gap Options For Addressing New York Revenue Shortfall

Personal Income Tax Revenues In New York State And City Cbcny

Personal Income Tax Revenues In New York State And City Cbcny

Personal Income Tax Revenues In New York State And City Cbcny

Personal Income Tax Revenues In New York State And City Cbcny

Historical New York Tax Policy Information Ballotpedia

Historical New York Tax Policy Information Ballotpedia

See The Evolution Of Local Tax Revenues In New York City Next City

See The Evolution Of Local Tax Revenues In New York City Next City

Local Government Office Of The New York State Comptroller

Local Government Office Of The New York State Comptroller

Personal Income Tax Revenues In New York State And City Cbcny

Personal Income Tax Revenues In New York State And City Cbcny

New York Budget Gap Options For Addressing New York Revenue Shortfall

New York Budget Gap Options For Addressing New York Revenue Shortfall

Comments

Post a Comment