- Get link

- X

- Other Apps

This cap remains unchanged for your 2020 and 2021 taxes. The deduction has a cap of 5000 if your filing status is married filing separately.

Salt Deduction What Is The State And Local Tax Deduction

Salt Deduction What Is The State And Local Tax Deduction

There was previously no limit.

Salt deduction 2021. The SALT deduction restrains tax competition by subsidizing high-tax states. Restoring the full SALT deduction would cost the US. 54 rows January 25 2021.

Trump capped those deductions at 10000. The politics of SALT can be a bit confusing. Congress revisits the SALT deduction.

A group of House lawmakers calling itself the SALT Caucus wants to reverse the cap and is pushing to include the restoration as part of the administrations massive spending bill for infrastructure. The push to revisit SALT which comes as Biden unveils his multi-trillion-dollar infrastructure proposal on Wednesday comes with a hefty price tag. Californians will be hearing a great deal about the so-called SALT deduction.

Treasury 887 billion in lost revenue for 2021 alone according to the Joint Committee on Taxation. April 20 2021 at 756 am EDT By Taegan Goddard Leave a Comment. Starting with the 2018 tax year the maximum SALT deduction became 10000.

This will leave some high-income filers with a higher tax bill. To allow unlimited deductions just in 2021 would cost 887 billion according to the Joint Committee on Taxation. As President Joe Biden and.

Fresh news now 0 As President Joe Biden and Congress push the next round of big tax hikes and spending bills Californians will be hearing a great deal about the so-called SALT deduction. Why Democrats Are In Revolt Over SALT Deduction. But the SALT deduction would.

887 billion for 2021. 52 rows As of 2019 the maximum SALT deduction is 10000. This limit applies to single filers joint filers and heads of household.

April 11 2021 at 1200 pm. The state and local tax deduction cap commonly known as SALT was enacted as part of President Donald Trumps 2017 tax reforms. The SALT deduction is a relatively bigger hit but theres not clear proof that rich people are fleeing high-tax states en masse because of it plus people move for plenty of reasons.

The major change made by the new tax law is that the entire deduction is capped at 10000 per return 5000 for married filing separately. As some lawmakers from high-tax Blue states push for the elimination of the Trump-era 10000 cap on state and local tax SALT deductions a new study from the left-leaning Institute on. SALT part of Trumps 2017 tax cut put a 10000 cap on federal deductions for state and local tax.

Democrats want that cap removed. In 2017 Republicans capped the SALT deduction at 10000 a progressive reform in an otherwise regressive bill. Newly released Internal Revenue Service data show the politically lopsided impact of the 10000 cap on deducting state and local taxes.

The limit is also important to know because the 2021 standard deduction is 12550 for single filers. The pinch that taxpayers in those states feel from high state and local taxes is eased by the break they get on their. SALT stands for state and local taxes and for many years prior to.

Doing so would literally save the rich billions of dollars in federal income tax. Lawmakers from both parties announced the SALT caucus which aims to scrap the 10000 limit on state and local deductions set as part of the 2017 Republican tax law. SALT stands for state and local taxes and for many years prior to President.

Salt Cap Repeal Salt Deduction And Who Benefits From It

Salt Cap Repeal Salt Deduction And Who Benefits From It

/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png) Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

Ny U S Lawmakers Introduce Legislation To Remove Salt Deduction Cap Wamc

Ny U S Lawmakers Introduce Legislation To Remove Salt Deduction Cap Wamc

Salt Deduction What Can We Learn From 2018 Tax Year Returns

Salt Deduction What Can We Learn From 2018 Tax Year Returns

House Democrats Stimulus Bill Rolls Back 10 000 Salt Cap For 2 Years

House Democrats Stimulus Bill Rolls Back 10 000 Salt Cap For 2 Years

Salt Deduction Limits And Pass Through Entities Dallas Business Income Tax Services

Salt Deduction Limits And Pass Through Entities Dallas Business Income Tax Services

Schumer And Gillibrand Launch New Push To Permanently Restore Nys S Full Salt Deduction Wivt Newschannel 34

Schumer And Gillibrand Launch New Push To Permanently Restore Nys S Full Salt Deduction Wivt Newschannel 34

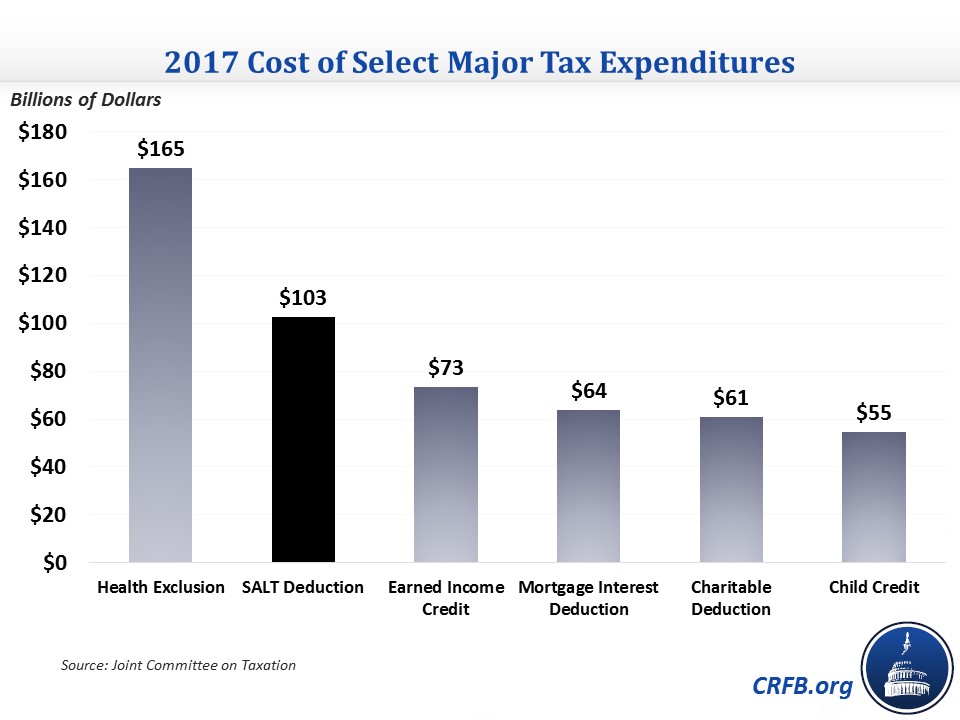

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Salt Cap Workarounds Will They Work Accounting Today

Salt Cap Workarounds Will They Work Accounting Today

House Members Unite To Try To Restore Salt Deduction Local News Buffalonews Com

House Members Unite To Try To Restore Salt Deduction Local News Buffalonews Com

Loosening The Salt Cap Is Poorly Targeted Committee For A Responsible Federal Budget

Loosening The Salt Cap Is Poorly Targeted Committee For A Responsible Federal Budget

Cuomo Murphy Urge Congress To Cut The Salt Deduction Killing New York New Jersey Taxpayers Amnewyork

Cuomo Murphy Urge Congress To Cut The Salt Deduction Killing New York New Jersey Taxpayers Amnewyork

Changes To Federal Salt Deduction Expose Illinois High Taxes

Changes To Federal Salt Deduction Expose Illinois High Taxes

Comments

Post a Comment