- Get link

- X

- Other Apps

There are a total of 988 local tax jurisdictions across the state collecting an average local tax of 4229. New York new employer rate.

Adopted Tax Rate New York City Rating Walls

Adopted Tax Rate New York City Rating Walls

More than 5 million but not over 25 million.

New york tax rate 2020. Not more than 100000. Part-year Yonkers resident tax. NYS adjusted gross income is MORE than 107650.

Fixed Dollar Minimum Tax is. New York state income tax rate table for the 2020 - 2021 filing season has eight income tax brackets with NY tax rates of 4 45 525 59 609 641 685 and 882 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. New York City or Yonkers Tax.

Yonkers nonresident earnings tax. New York has eight marginal tax brackets ranging from 4 the lowest New York tax bracket to 882 the highest New York tax bracket. Also theres an additional sales tax of 0375 on sales made within the Metropolitan Commuter Transportation District.

New York Income Taxes. 2020 New York Tax Tables with 2021 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. New York has 2158 special sales tax jurisdictions with local sales.

Counties and cities can charge an additional local sales tax of up to 4875 for a maximum possible combined sales tax of 8875. With this change the highest combined New York State and City tax rate on corporations would be 18275 725 New York State plus 2175 Metropolitan Transit Authority plus 885 New York City 9 for large financial institutions. New Yorks income tax rates were last changed one year ago for tax year 2019 and the tax brackets were previously changed in 2016.

The combined sales and use tax rate equals the state rate currently 4 plus any local tax rate imposed by a city county or school district. The state applies taxes progressively as does the federal government with higher earners paying higher rates. New York States top marginal income tax rate of 882 is one of the highest in the country but very few taxpayers pay that amount.

3525 plus corresponding subsidiary fund percent. If you are in the 10 or 15 tax bracket 2016 incomes up to 75900 for those married filing jointly your long-term capital gains tax rate is 0. More than 250000 but not over 500000.

Part-year NYC resident tax. Rates kick in at different income levels depending on your filing status. An additional sales tax rate of 0375 applies to taxable sales made within the Metropolitan Commuter Transportation District MCTD.

For example the sales tax rate for New York City is 8875 while its 75 in Ontario County. While short-term tax rates are the same as ordinary income tax rates which top out at 396 long-term capital gains range from 0 to a top of 20. 075 totaling 36 for 2020.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Use the NYS tax computation. New York state income tax brackets and income tax rates.

New York has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4875. More than 100000 but not over 250000. More than 1 million but not over 5 million.

New York City has four separate income tax brackets that range from 3078 to 3876. New York state income tax rates are 4 45 525 59 609 641 685 and 882. Check the states website for a list of sales-and-use tax rates by jurisdiction.

The lowest rate applies to single and married taxpayers who file separate returns on incomes of up to 12000 as of 2020. Click here for a larger sales tax map or here for a sales tax table. More than 500000 but not over 1 million.

The Amount of New York State Tax Withholding Should Be. Where you fall within these brackets depends on your filing status and how much you earn annually. New York City has four tax brackets ranging from 3078 to 3876.

If New York City Receipts are. For your 2020 taxes which youll file in early 2021 only individuals making more than 1077550 pay the top rate and earners in the. Metropolitan commuter transportation mobility tax MCTMT MCTMT.

NYS tax rate schedule. The New York state sales tax rate is 4 and the average NY sales tax after local surtaxes is 848. Groceries prescription drugs and non-prescription drugs are exempt from the New York sales tax.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

2020 State Individual Income Tax Rates And Brackets Tax Foundation

2020 State Individual Income Tax Rates And Brackets Tax Foundation

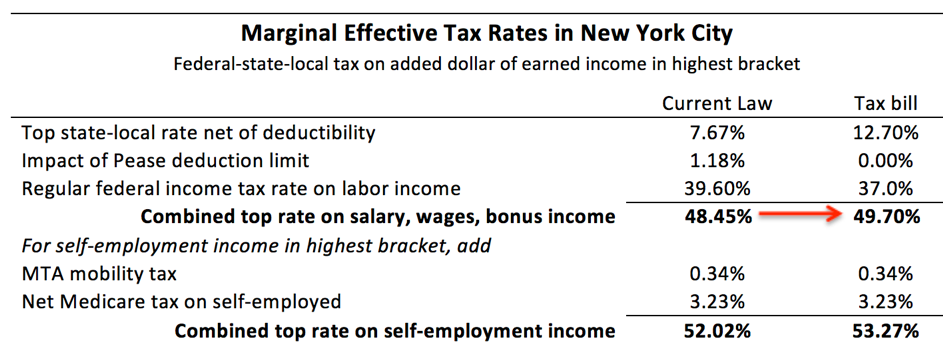

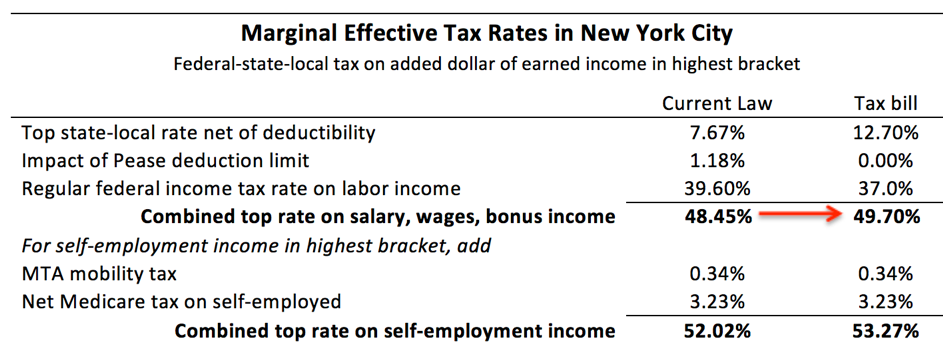

New York Taxes Layers Of Liability Cbcny

New York Taxes Layers Of Liability Cbcny

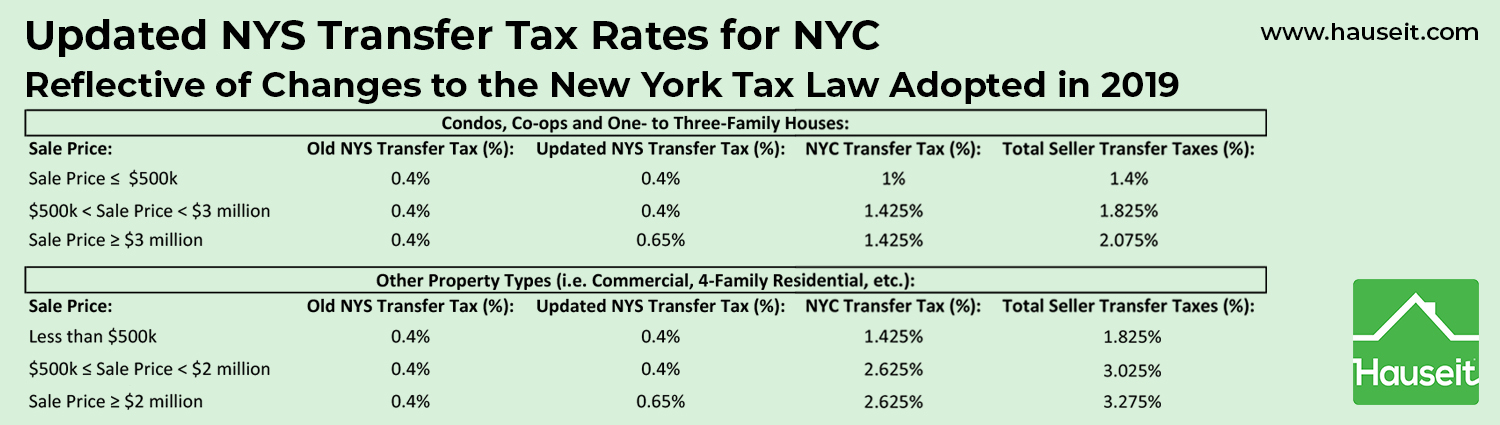

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

New York Taxes Layers Of Liability Cbcny

New York Taxes Layers Of Liability Cbcny

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

Do States Like New York And California Really Have High Taxes Quora

Nyc S High Income Tax Habit Empire Center For Public Policy

Nyc S High Income Tax Habit Empire Center For Public Policy

Http Nysac Membershipsoftware Org Files Nysactaxwhitepaper 1 Pdf

Testimony Fy2020 New York State Budget Taxes Empire Center For Public Policy

Testimony Fy2020 New York State Budget Taxes Empire Center For Public Policy

Comments

Post a Comment