- Get link

- X

- Other Apps

On the other hand I had a client whose return took over a week to prepare when I worked in a large firm which cost the client around 100000. The National Society of Accountants conducts an annual survey of its members to determine average fees for preparing a range of tax returns.

/tax-preparation-prices-and-fees-3193048_color22-02e553ad83d64fb6803944caea928d8b.gif) How Much Is Too Much To Pay For Tax Returns

How Much Is Too Much To Pay For Tax Returns

The answer to both questions is the same.

How much do cpas charge for taxes. Ad CPA HD Notes 100s Of Practice MCQ CPA Exam Prep Courses. HD your CPA Exam. Theres a broad hourly range as to what theyll charge but you should expect to pay between 100 250 per hour.

For example my uncle has a simple tax return and pays 250 in preparation fees. HD your CPA Exam. Ad CPA HD Notes 100s Of Practice MCQ CPA Exam Prep Courses.

According to the National Society of Accountants a CPA may charge between 68 and 800 depending on the forms you need to file as well as how detailed they are and how difficult it is to gather the appropriate information from your books. CPAs will also charge clients an hourly rate to prepare tax returns. To hire a Tax Preparer to prepare your taxes you are likely to spend between 150 and 200 total.

How much do CPAs charge. A Form 1040 with a Schedule A and a state tax return will run you an average of about 273. Study the CPA Program with the level of support you need to succeed.

The average cost for a Tax Preparer is 190. CPA charges may vary depending on your state the services you need and amount of experience. A good CPA may cost you more upfront but will pay off in the long run because he or she is thorough.

Some factors that determine costs include. For complex ones their fee can go up to. Study the CPA Program with the level of support you need to succeed.

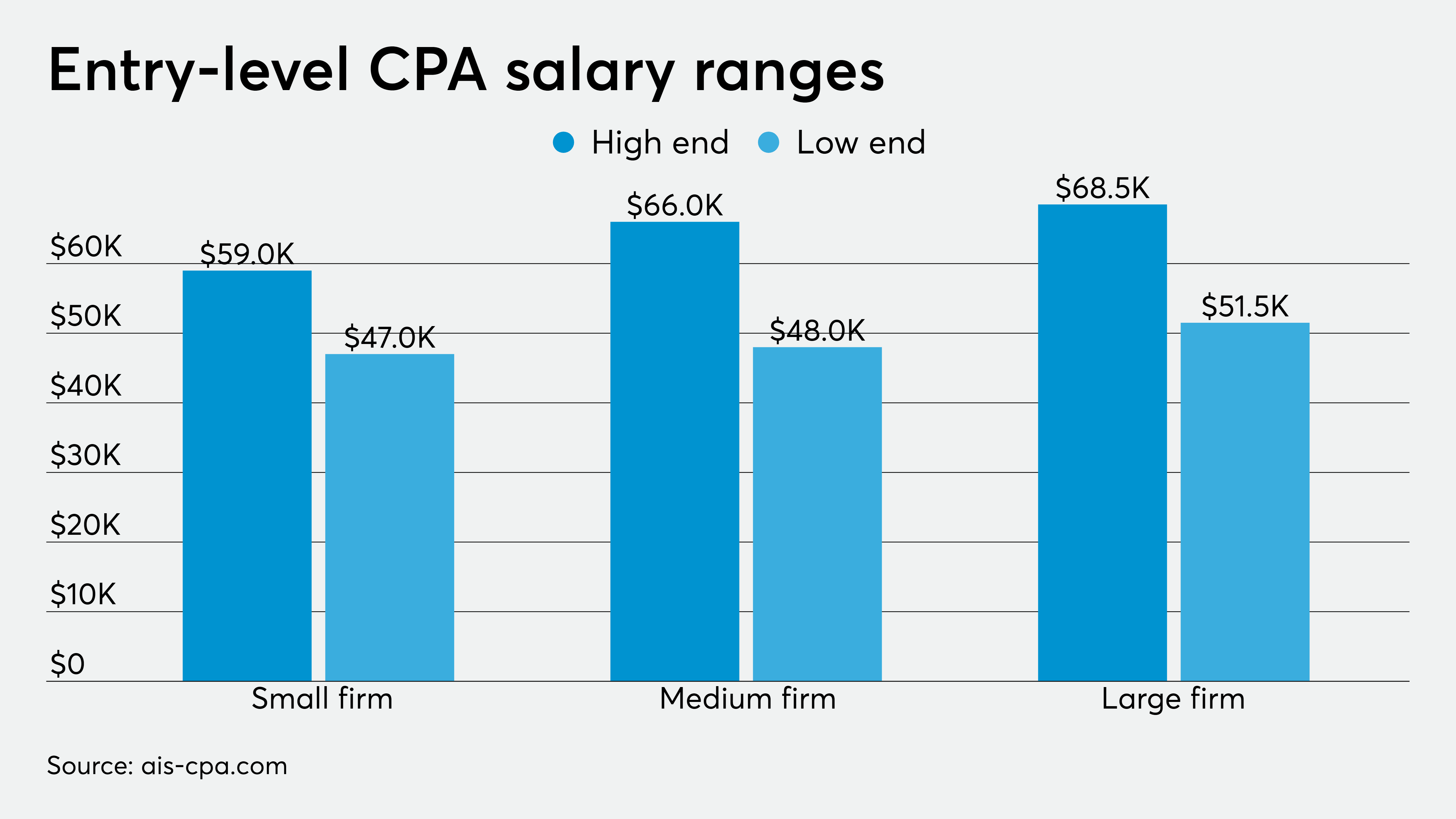

Smaller firms with lower gross earnings each year may charge an average CPA hourly rate between 30 and 50 per hour depending on the tasks for which you hired them. According to the National Society of Accountants the average cost to hire a CPA in the United States ranges from 457 for an itemized Form 1040 with Schedule C and a state tax return to 176 for a Form 1040 with a state tax return. The 2013 survey found that accountants charge an average of 261 to prepare and file an itemized Form 1040 with Schedule A and a state tax return.

The average cost of hiring a certified public accountant CPA to prepare and submit a Form 1040 and state return with no itemized deductions is 176 while the average fee for an itemized Form. To get a more accurate picture of professional accounting costs set up a free consultation with an accounting professional. Taxpayers without itemized deductions pay an average of 152.

The average cost of hiring a certified public accountant CPA to prepare and submit a Form 1040 and state return without itemized deductions is 176 while the average fee for Form 1040 items and tax return is 176. CPA Tax Preparation Fees One of the biggest tasks for which consumers and businesses. Firms reported that on average 573 of gross income comes from tax-return preparation 154 from write-up work 89 from payroll services 70 from tax services 36 from QuickBooks.

CPAs charge more than regular accountants or tax preparers says Jiang. Before doing that however lets break down the various pricing structures and services available for professional financial accounting services. How much you pay will depend on how complex your tax return is.

Ad Study the CPA Program with the level of support you need to succeed. For a simple tax return they might charge anywhere from 375 to 500. Ad Study the CPA Program with the level of support you need to succeed.

In major cities however a tax accounting firms top talent might command up to 500 per hour. Small Tax-Exempt entities average 600 1500 Does Not Include Federal Fee About 400 to 850.

How To Find An Accountant To Do Your Tax Return And What You Should Pay Self Assessment Tax The Guardian

How To Find An Accountant To Do Your Tax Return And What You Should Pay Self Assessment Tax The Guardian

How To Find The Best Cpa For Your Business Biggerpockets

How To Find The Best Cpa For Your Business Biggerpockets

How To Find The Best C P A Or Tax Accountant Near You The New York Times

How To Find The Best C P A Or Tax Accountant Near You The New York Times

Average Tax Preparation Fees Hit 273 For 1040 And One State Cpa Practice Advisor

Average Tax Preparation Fees Hit 273 For 1040 And One State Cpa Practice Advisor

Cpa Fees In 2020 How Much Does A Cpa Cost Prices Rates Per Hour Fee Schedule Advisoryhq

Cpa Fees In 2020 How Much Does A Cpa Cost Prices Rates Per Hour Fee Schedule Advisoryhq

How To Find The Best Tax Preparer Or Cpa Forbes Advisor

How To Find The Best Tax Preparer Or Cpa Forbes Advisor

How Much Does It Cost To Hire A Cpa Taxhub

How Much Does It Cost To Hire A Cpa Taxhub

Hiring An Accountant To Do Your Taxes Vs Using Turbo Tax Or Tax Cut

Hiring An Accountant To Do Your Taxes Vs Using Turbo Tax Or Tax Cut

Nsa Survey Reveals Fee And Expense Data For Tax Accounting Firms In 2016 And 2017 Projections

Nsa Survey Reveals Fee And Expense Data For Tax Accounting Firms In 2016 And 2017 Projections

How Much Do Accountants And Cpas Really Earn Accounting Today

How Much Do Accountants And Cpas Really Earn Accounting Today

Hiring A Cpa How Much Does It Cost To Have A Cpa Do Your Taxes Trending Us

Hiring A Cpa How Much Does It Cost To Have A Cpa Do Your Taxes Trending Us

How Much Does An Accountant Charge

How Much Does An Accountant Charge

Cpa Fees In 2020 How Much Does A Cpa Cost Prices Rates Per Hour Fee Schedule Advisoryhq

Cpa Fees In 2020 How Much Does A Cpa Cost Prices Rates Per Hour Fee Schedule Advisoryhq

How Much Should Accounting Cost A Small Business Costs Averages

How Much Should Accounting Cost A Small Business Costs Averages

Comments

Post a Comment