- Get link

- X

- Other Apps

As long as you continue to pay your insurance premiums each month youll pay the same rate during the entire term length which for many term policies is typically 10 15 20 or 30 years. Larry Tew Financial Raleigh NC.

When initial premium is collected and policy is issued C.

When does a life insurance policy typically become effective. Traditionally life insurance becomes effective after the policy has been issued you have paid the first premium with a check and signed and returned the delivery paperwork. Below are three different scenarios. It also marks when youll have to pay your monthly premium for the first time.

To reduce the possibility of fraud on life insurance policies insurers have instituted a waiting period before the policy becomes effective. Expiration date Exact day when insurance coverage ends. When the completed application is signed and initial premium is collected.

When the application is completed and signed D. On the day you apply for insurance coverage. Does Life Insurance Start Immediately.

Your coverage will not be effective until your policy is delivered and your initial life insurance premium is paid. After you have taken a medical exam and your rates have been adjusted to meet the level of risk you present there is still a waiting period. A life insurance policy typically becomes effective once you meet specific milestones.

Premium collected with the application. It begins at the exact timing requested on the application ie. A life insurance policy goes into effect after the application has been submitted the underwriting has been completed the life insurance approval has been made the policy has been issued and the policy holder and insured person have signed any necessary delivery requirements and made the first premium payment by check or auto draft.

When applicant pays initial premium coverage is effective on the condition that applicant proves to be insurable either on date of signature or date of medical exam. The date that your life insurance policy takes effect is based on several factors. Before the effective date you do not have any life insurance coverage.

When producer delivers policy and collects initial premium T applies for a life insurance policy and is told by the producer that the insurer is bound to the coverage as of the date of the application or medical examination whichever is later provided that T is an acceptable risk. The timing of life insurance becoming effective depends on a few things. The effective date is the day a policy is considered to be active or in force.

When does a life insurance contract become effective if the initial premium is not collected during the application process. When the policy is issued B. Inception date Exact date a policy goes into effect.

Generally speaking coverage begins when the insurance company has received and approved the application for coverage a policy has been issued all additional documents have been signed. What is a binding receipt. However there are some variations on that.

This is usually the longest part of the underwriting process. It varies based upon the insurance company so its very important to specifically ask your life insurance agent when your specific life insurance coverage begins. Operative on the application date if approved.

When the policy is issued When initial premium is collected and policy is issued When the application is completed and signed. This may also be referred to as the policy date. Read the legal language carefully.

Contract law requires signed authorization signed application and consideration one month of premium. When all those conditions are met the policy is in force or in effect. If the process goes smoothly and you are able to secure a medical examination within 3-5 days the life insurance application process could take as little as 2-3-4 weeks and as much as 6-8 weeks.

If you apply for life insurance and submit the minimum initial premium with the application the companys conditional receipt will determine when the coverage begins. Each companys terms will be a little different. A life insurance policy becomes effective when the first premium is paid and the insurance company accepts the application and underwriting approves the application.

Your age is one of the primary factors influencing your life insurance premium rate whether youre seeking a term or permanent policy. When does a life insurance policy typically become effective. Coverage is guaranteed until insurer formally rejects application even if proposed insured is ultimately found to be uninsurable.

A policy with February 1 2020 as the effective date means that if the insured passes away on or after February 1 2020 the insurer will pay the death benefit to any listed beneficiaries. When the term ends you can either choose to end your life insurance coverage or renew your life insurance policy usually at a higher rate. When does a life insurance policy typically become effective.

This date goes by a few different names and is also known as the commencement date and policy start date the latter is what we here at Lemonade HQ call the effective date on our policies. Life insurance companies typically determine the effective date in the application and policy. An effective date is the time day month and year when your insurance coverage becomes active.

Understanding The Life Insurance Medical Exam Policygenius

Understanding The Life Insurance Medical Exam Policygenius

Enquetemarcada Insurance Beneficiary Pay Attention To Your Beneficiary Designation Outline Financial Mortgages Insurance Advisory There Are Typically Two Options For Receiving The The Beneficiary Of A Life Insurance Policy Is

Enquetemarcada Insurance Beneficiary Pay Attention To Your Beneficiary Designation Outline Financial Mortgages Insurance Advisory There Are Typically Two Options For Receiving The The Beneficiary Of A Life Insurance Policy Is

Three Ways A Life Insurance Policy Can Be Used

Three Ways A Life Insurance Policy Can Be Used

Ultimate Bridal Magazine 2013 2014 By Imagedesign Issuu

Ultimate Bridal Magazine 2013 2014 By Imagedesign Issuu

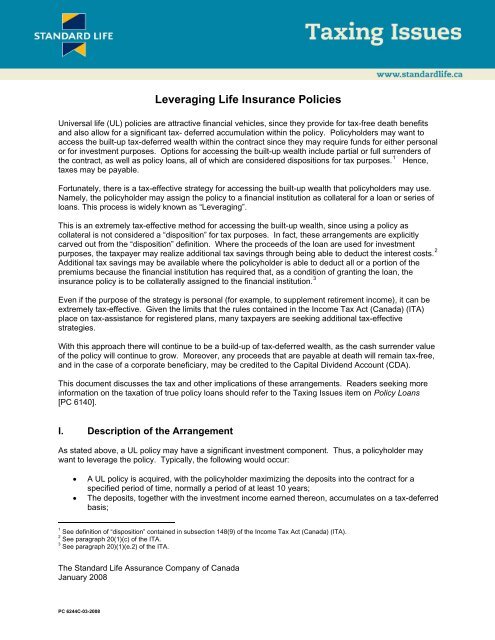

Leveraging Life Insurance Policiies Standard Life

Leveraging Life Insurance Policiies Standard Life

Whole Life Insurance How It Works

Money Back Life Insurance Policy Typically Yield An Effective Return Of 3 To 5

Money Back Life Insurance Policy Typically Yield An Effective Return Of 3 To 5

Buying Life Insurance Friedman Group

Life Insurance The Definitive Guide

Life Insurance The Definitive Guide

How Does Whole Life Insurance Work Cash Value Explained

How Does Whole Life Insurance Work Cash Value Explained

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

5 Different Types Of Insurance Policies Coverage You Need Mint

5 Different Types Of Insurance Policies Coverage You Need Mint

Education About Finance Insurance Types Of Life Insurance Policy

Comments

Post a Comment