- Get link

- X

- Other Apps

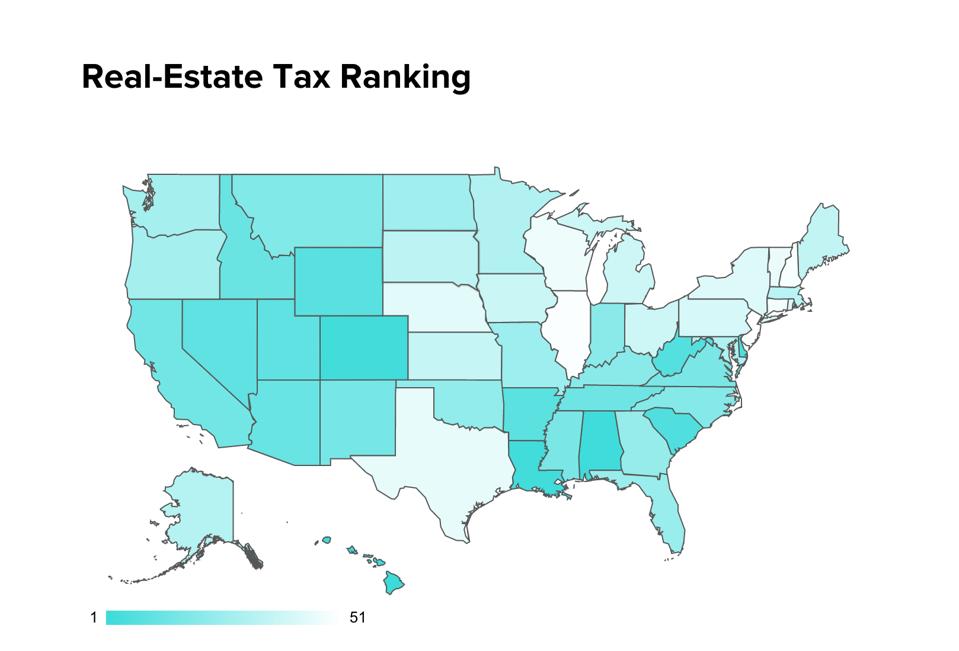

As a property owner and real estate investor the local property tax rate can and should influence your decision on where to invest. While Hawaii ranks No.

State Tax Levels In The United States Wikipedia

State Tax Levels In The United States Wikipedia

A median house in Ohio valued at 129900 brings in 2032 in property taxes.

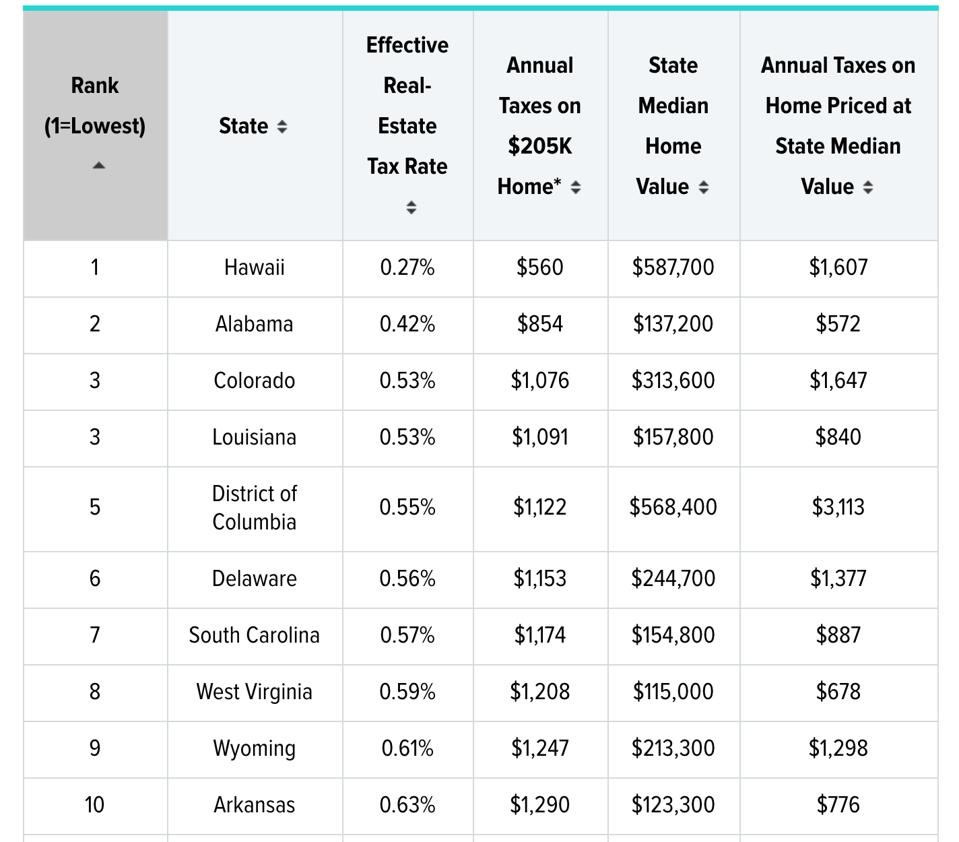

States with lowest real estate taxes. 3378 056 South Carolina. Hawaii currently has the lowest property tax rate at 030 while Illinois has the highest rate at 222. 890 055 District of Columbia.

Friendly Accommodating Staffs Will Help You With Any Inquiries. 51 rows Property Tax. Alabama Oklahoma and Arkansas have the lowest property tax per capita.

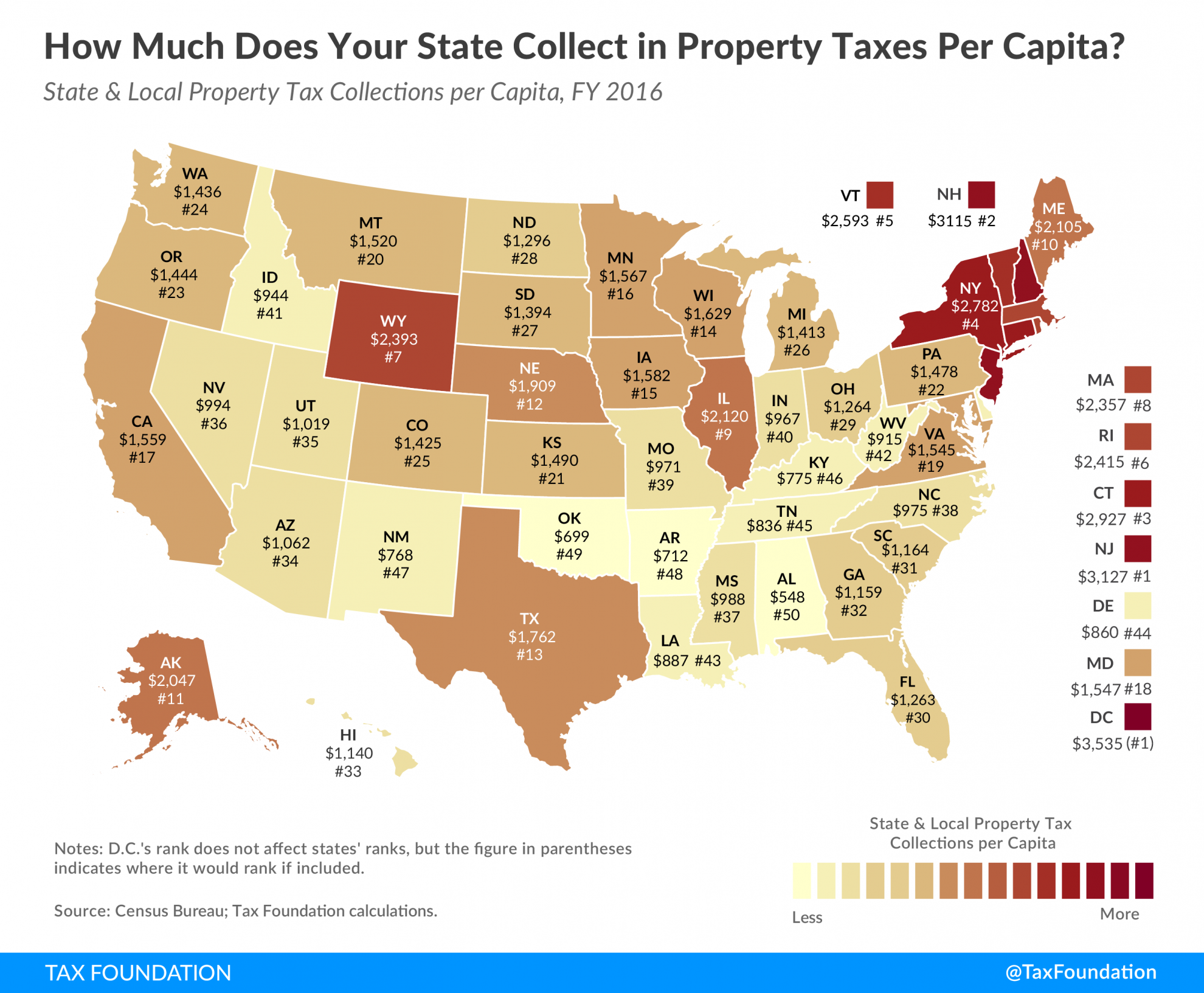

Top 10 States With The Highest Property Taxes. The difference between Louisiana the state with the lowest rate and New Jersey with the highest rate is a significant 171 percentage points. In Alabama the per capita amount paid is only 582 while in Oklahoma and Arkansas its 731 and 741 respectively.

Get In Touch With Us Now. These 11 states boast the lowest effective property tax rates in the country. Get In Touch With Us Now.

Lowest property tax rates States with the lowest effective property tax rates were Hawaii 036 Alabama 048 Colorado 052 Utah 056 and Nevada 058. Alabama West Virginia Louisiana Arkansas South Carolina Wyoming and Mississippi all rank among the states with the lowest property taxes regardless of whether you rank by tax rate or total property taxes collected for the average property. With a difference of 192 this shows us that property taxes vary significantly from state to state.

Hawaii With the lowest effective property tax rate in the nation Hawaii residents only pay 035 of their home value. Friendly Accommodating Staffs Will Help You With Any Inquiries. Ad Leading Real Estate Servicing All Of Bundaberg And The Surrounding Regions.

But in California the tax rate is much. That breaks down to an average of 366 of income going to property taxes the 12th highest in the US 0 in income taxes and 144 of income going to excise taxes. Alaska offers the lowest total tax burden of any state costing taxpayers an average of 51 of their income.

Effective Real-Estate Tax Rate. 1 for having the lowest property taxes Illinois and New Jersey come in last with the nations highest annual property taxes. States with the lowest property taxes.

Ad Leading Real Estate Servicing All Of Bundaberg And The Surrounding Regions. Annual Taxes on Home Priced at State Median Value. However Hawaii also has the highest median home values in the US.

Unfortunately all states have property taxes. In Ohio the tax property rate is the 12th highest in the country at 156. Connecticut is the only other state whose per capita property tax by state is over 3000 3020.

Luckily 28 states have property. This figure might not sound like much at first glance but it can come out to a pretty significant tax bill when its correlated to. States Without Property Taxes.

Annual Taxes on 2175K Home State Median Home Value.

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Low Tax States Are Often High Tax For The Poor Itep

Low Tax States Are Often High Tax For The Poor Itep

Property Taxes Per Capita State And Local Property Tax Collections

Property Taxes Per Capita State And Local Property Tax Collections

Report Kansans Paying More Real Estate Vehicle Property Tax Than Average

Report Kansans Paying More Real Estate Vehicle Property Tax Than Average

2020 Report Ranks U S Property Taxes By State

2020 Report Ranks U S Property Taxes By State

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

Real Estate Taxes By State 2012 Eye On Housing

Real Estate Taxes By State 2012 Eye On Housing

How High Are Property Taxes In Your State Tax Foundation

How High Are Property Taxes In Your State Tax Foundation

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

2020 Report Ranks U S Property Taxes By State

2020 Report Ranks U S Property Taxes By State

How High Are Property Taxes In Your State Tax Foundation

How High Are Property Taxes In Your State Tax Foundation

Property Tax Map Tax Foundation

Property Tax Map Tax Foundation

Nahb Residential Real Estate Tax Rates In The American Community Survey

Comments

Post a Comment