- Get link

- X

- Other Apps

Get A 100 Accuracy Guarantee With HR Block for your US. How would you do it.

How To File Your Taxes The Complete Guide To Business And Individual Tax Filing Ageras

How To File Your Taxes The Complete Guide To Business And Individual Tax Filing Ageras

Citizens will need to file a federal income tax return every year and determine how much they owe in federal income tax.

How do tax returns work. Should you file a tax return. What do you need for it. Once payments have been input returns are sorted into work blocks so that employees can process them.

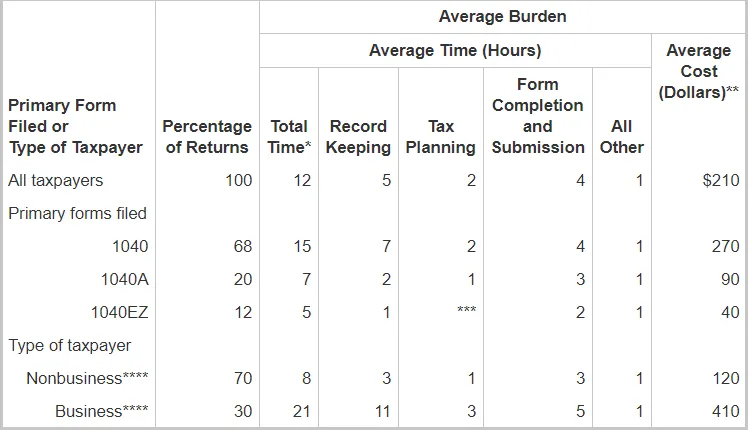

Federal Income Tax Returns Most US. A machine presorts and opens all incoming mail separating returns that include payments from those that do not by detecting magnetic ink on checks. Youre required to file a tax return every year to come up with a final tally of your tax situation.

Do you work in Austria and are unable to grasp their tax system. Ad Trust The Experts At HR Block To Guide You Step By Step Through Your Expat Taxes. The Australian Tax Office or ATO is responsible for ensuring individuals companies trusts and other entities lodge their tax returns appropriately.

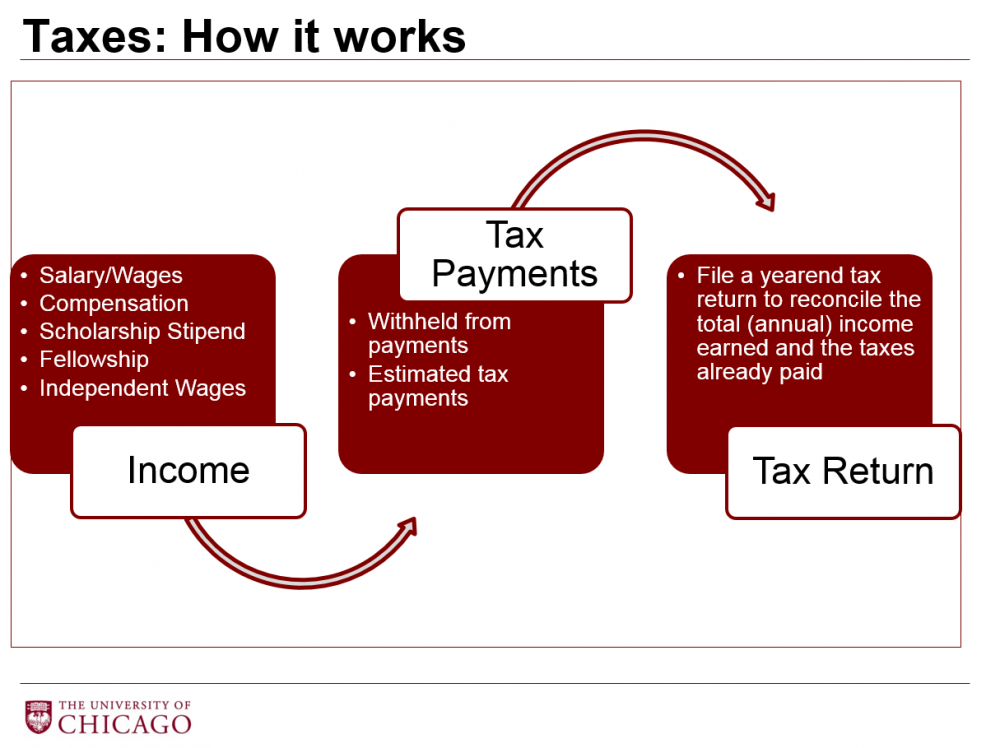

Tax refunds may also be due for income deductions that are applied after the tax year has ended if one finishes working prior to the year end or for joint assessment of taxes for a married couple. The process determines whether you owe taxes beyond what youve already paid or whether youre owed a refund of the taxes that have been withheld. The W-4 form is like a miniature income tax survey.

Employees then further manually sort returns entering checks for deposit. Your tax return is normally due on or near April 15 of the year following the tax year. How Do Tax Returns Work.

Due to the complexities of the tax system its difficult to know how much tax to apply until all the income for a year has been. Depending on the size and scale of your business you may want to hire an accountant. A tax return is a form or series of forms that compose a statement of your income expenses liability and taxes youve already paid to the IRS throughout the year.

The process begins when you start a new job. Your locality usually the county determines the value of your home and then you pay taxes based on that value. The tax you pay is based on your taxable income Taxable income The amount of income you have to pay tax on after tax credits and deductions.

The tax system uses a self-assessment program. Income Taxes Explained in 100 Pages or Less. Ad Trust The Experts At HR Block To Guide You Step By Step Through Your Expat Taxes.

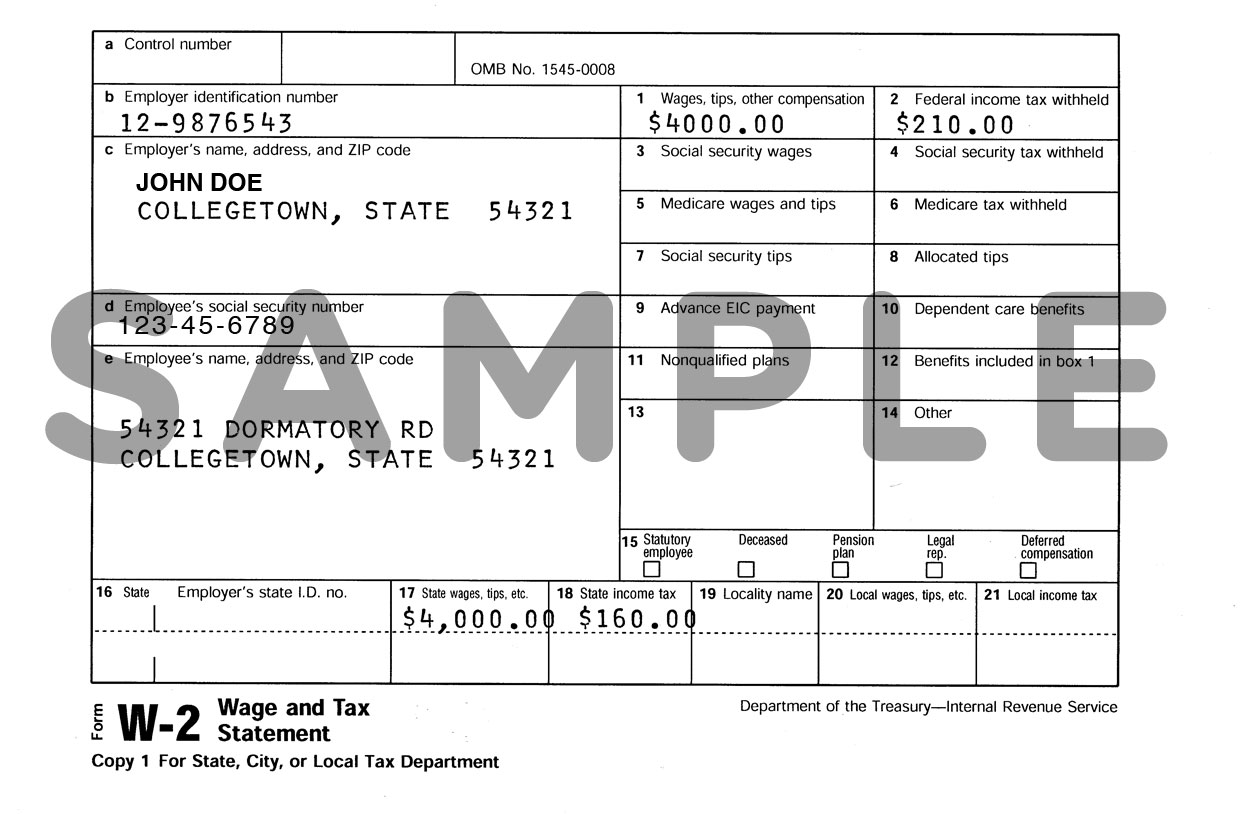

The next thing you do is fill out a W-4 form. Whether you are a salaried or hourly employee or you are a freelancer or independent contractor youll file your taxes by filling out IRS Form 1040. Get A 100 Accuracy Guarantee With HR Block for your US.

The rate of tax increases as your taxable income increases and exceeds certain amounts called tax brackets. You have to provide your name address and Social Security number. If youre filing a tax return as a sole proprietor many of your write-offs will be claimed on Schedule C of your 1040.

Youll report your income and tax deductions on this form. You and your employer agree on your compensation an hourly wage or an annual salary which adds up to your gross or before tax income. Therefore everyone is responsible for reporting their own tax to.

How property taxes work The general process behind property taxes is simple. You are required to report your total income to the Canada Revenue Agency CRA when you file your tax return. To some people who dont prepare their own tax returns its a mystery how the refund.

Be sure to know the rules about what deductions youre entitled to. Tax returns are the primary way that the federal government and state governments check that they are receiving the correct amount of income tax from you. Tax refunds must be claimed within four years of the end of the tax year if.

The Step-by-Step Process Your 1040 begins with your personal information. Have come to expect a sizable refund check every tax season. However the exact process is a lot more complicated in certain areas because each local government sets its own process.

Income tax is levied on almost every person and business entity living in or operating out of the US. A joint return will require your spouses information as well. The following is an excerpt from my book Taxes Made Simple.

Many taxpayers in the US. Read full definition. Below we go over the basic process.

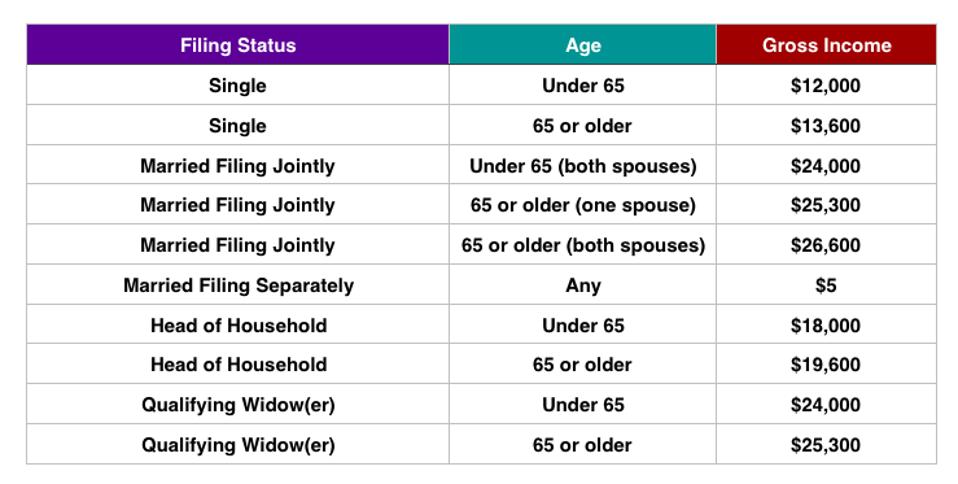

Throughout the year the austrian tax system takes so called tax advances which at the end of the tax year cumulate in the form of a tax returnYou are entitled to a tax refund if your employer deducted a higher amount of tax from your paycheck. Once you enter your tax information on your W-2s 1099s and other relevant forms tax software will automatically calculate how much tax you. While the majority of people are required to file and pay income taxes there are certain low-income earners as well as children who are exempt.

How Do Tax Brackets Work Understanding Taxes Centsai

How Do Tax Brackets Work Understanding Taxes Centsai

How Long Does It Take To File Your Tax Return And Get Your Tax Refund Freshbooks

How Long Does It Take To File Your Tax Return And Get Your Tax Refund Freshbooks

Dude Where S My Refund The Turbotax Blog

Filing Your Taxes Work Travel Usa Interexchange

Filing Your Taxes Work Travel Usa Interexchange

How The Jefferson County Occupational Tax Refund Process Will Work Al Com

Do You Need To File A Tax Return In 2019

Do You Need To File A Tax Return In 2019

How It Works United Tax Returns

Your Last Paycheck And Your Tax Return Apex Foundation Apex Foundation

How Income Taxes Work Howstuffworks

How Income Taxes Work Howstuffworks

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

A Beginner S Guide To Filing A Tax Return

A Beginner S Guide To Filing A Tax Return

Comments

Post a Comment