- Get link

- X

- Other Apps

The Substantially Equal Periodic Payment rule allows you to take money out of an IRA before the age of 59 12 and avoid the 10 early distribution penalty tax. One exception others include.

72t Distributions The Ultimate Guide To Early Retirement Above The Canopy

Updated March 30 2021.

Rule of 55 vs 72t. Leaving Your Job On or After Age 55 The age 59½ distribution rule says any 401k participant may begin to withdraw money from his or her plan after reaching the age of 59½ without having to pay a 10 percent early withdrawal penalty. 72t distributions usually require help from a tax professional to set up correctly. This approach is also referred to as 72 t payments because the rule falls under IRS code section 72 t.

It must be a 401k - cannot be an IRA. The Age 55 Rule allows you to take any amount at any time with no penalty if youve left employment on or after the year that youll reach age 55. 72T - Distributions can occur at any age calculating life expectancy and use that to calculate 5 substanitally equal payments from a retirement plan for 5 years in a row before the age of 59.

These are two different rules completely. Most often when you take money from your retirement account before you turn 59 ½ you are assessed a 10 penalty on the top of ordinary income tax. That is under the Rule of 55 a person can take distributions from the 401k plan of hisher last employer at any amounts and intervals subject to the specific 401k plan guidelines.

To use the rule of 72 divide 72 by the annual rate of return. The rule of 55 is an IRS guideline that allows you to avoid paying the 10 early withdrawal penalty on 401k and 403b retirement accounts if you leave your job during or after the calendar year. Under the terms of this rule you can withdraw funds from your current jobs 401k or 403b plan with no 10 tax penalty if you leave that job in or after the year you turn 55.

Rule of 55 - an employee who retires quits or is fired at age 55 or after can withdraw without penalty from their 401K. The rule of 55 is an IRS provision that allows those 55 or older to withdraw from their 401k early without penalty. You must continue withdrawals until standard retirement age whether you need the money or not.

The IRS Rule of 55 allows an employee who is laid off fired or who quits a job between the ages of 55 and 59 12 to take money from their 401k or 403b plan without the 10 penalty for early withdrawal. 72 t early distribution analysis. 1 This applies to workers who leave their jobs anytime during or after the year of their 55th birthdays.

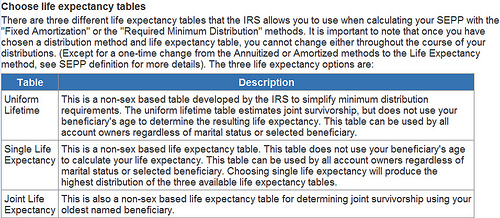

The classic 72t rule requires you to take a specific amount each year for the longer of 1 five years or 2 when you reach age 59 12. Its known as the Substantially Equal Periodic Payment SEPP exemption or an IRS Section 72t distribution. Internal Revenue Code IRC Section 72 t 2 A iv defines these distributions as Substantially Equal Periodic Payments.

Annuities are considered qualified when theyre held in a qualified retirement account. This article appears to be confusing the Rule of 55 with the IRS section 72t distribution rules. Essentially the Rule of 55 is a way for investors to draw on their 401k assets prior to the typical magic age of 59 ½ which is the age at which youd normally avoid an extra 10.

They are not connected as far as i know. While 72 t applies to early withdrawals from a retirement account 72 q applies to early withdrawals from a non-qualified annuity. First-time home purchase college tuition payments disability to that is a 72 t distribution that is a substantially equal periodic payments.

Rule 72 t actually refers to code 72 t section 2 which specifies exceptions to the early-withdrawal tax that allow IRA owners to withdraw funds from their retirement account before age 59½. You must continue withdrawals whether it makes sense to or not which means you could be. The exception may apply to those who are leaving their employer either.

Rule of 55 - Per IRS Publication 575 the Rule of 55 allows an employee who retires quits or is fired at age 55 to withdraw without penalty from their 401 k. The rule of 72 is a simple method to determine the amount of time investment would take to double given a fixed annual interest rate. This might be a 401 k IRA 403 b TSA or defined benefit pension plan.

If you choose to use 72 t payments also called SEPP. The IRS Rule of 55 allows an employee who is laid off fired or who quits a job between the ages of 55 and 59 12 to pull money out of their 401k or 403b plan without penalty. IRS Rule of 55 vs.

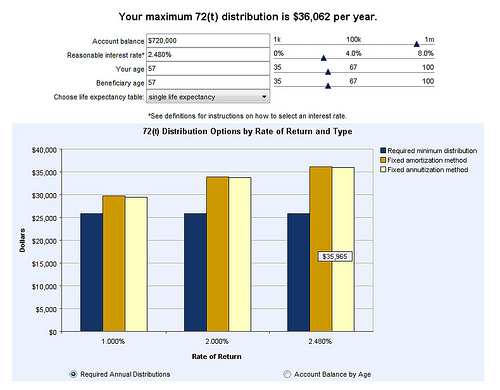

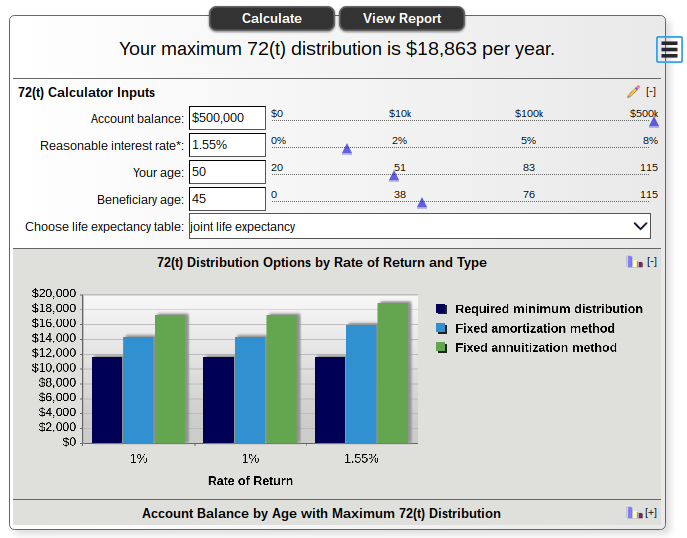

The 72 t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty.

72t Distributions The Ultimate Guide To Early Retirement Above The Canopy

The 72 T Rule Or How To Withdraw Retirement Funds Early Without Paying Penalties Military Dollar

The 72 T Rule Or How To Withdraw Retirement Funds Early Without Paying Penalties Military Dollar

72t Distributions The Ultimate Guide To Early Retirement Above The Canopy

72t Distributions The Ultimate Guide To Early Retirement Above The Canopy

How To Access Retirement Funds Early

How To Access Retirement Funds Early

What Is The Rule Of 72t And 55 Wiser Wealth Management

What Is The Rule Of 72t And 55 Wiser Wealth Management

How To Access Retirement Funds Early

What Is The Rule Of 55 Forbes Advisor

What Is The Rule Of 55 Forbes Advisor

Six Ways To Access Retirement Funds Early Personal Finance Club

Six Ways To Access Retirement Funds Early Personal Finance Club

Is Rule 72 T The Escape Tool For Me Route To Retire

Is Rule 72 T The Escape Tool For Me Route To Retire

Retiring Early Don T Forget About 72 T Good Financial Cents

Retiring Early Don T Forget About 72 T Good Financial Cents

Retiring Early Don T Forget About 72 T Good Financial Cents

Retiring Early Don T Forget About 72 T Good Financial Cents

The 72 T Rule Making Penalty Free Ira Withdrawals Before Age 59 Seeking Alpha

The 72 T Rule Making Penalty Free Ira Withdrawals Before Age 59 Seeking Alpha

/GettyImages-1077182236-5c24effec9e77c0001e417cc.jpeg)

:max_bytes(150000):strip_icc()/what-is-the-rule-of-55-2894280-v1-fa6b42c5a8f647e8aa5776a550c121a5.png)

Comments

Post a Comment