- Get link

- X

- Other Apps

Redlining a legal theory traditionally associated with mortgage lending is the more familiar theme of fair lending concern in this area and stems from the possibility that consumers will be excluded from advertising for financial products because of prohibited factors like age gender or race. Redlining is the systematic denial of various services or goods by governments or the private sector either directly or through the selective raising of prices.

Redlining The Doj S Initiative On Fair Lending Penn Undergraduate Law Journal

Focus on Fair Lending Redlining Emerging In September the Consumer Financial Protection Bureau CFPB and the Department of Justice DOJ announced a joint action against Hudson City Savings Bank Hudson City for discriminatory redlining practices that denied residents in majority-Black-and-Hispanic neighborhoods fair access to mortgage loans.

Redlining fair lending. Fair Lending Fair Lending Laws and Regulations FDIC Consumer Compliance Examination Manual March 2021 IV 13 Redlining is a form of illegal disparate treatment in which a lender provides unequal access to credit or unequal terms of credit because of the race color national origin. The word itself is rooted back to the early 1930s after the color correlating property value grading system was developed by the Home Owners Loan Corporation thus the word RED-lining being that the color red was used on financial maps to. This video provides an overview of redlining discrimination risk and discusses how a banks compliance management system can help address such risk.

We are committed to fair lending and continually review our compliance programs to ensure that all loan applicants are receiving fair treatment Boston-based Santander Bank said in a statement. Although redlining a form of lending discrimination has been outlawed for decades its scars remain visible in many communities across the US experts say. Disparate Impact Fair Lending Redlining.

This is the first checklist in the new series revolving around Disparate Impact Fair Lending and Redlining. Redlining risk is the potential fair lending risk stemming from the disproportionate lack of lending to majority-minority census tracts within individual markets. Struggle for black and Latino mortgage applicants suggests modern-day redlining.

Checklist Number Two-Market Delivery. Disparate Impact Fair Lending Redlining. Read on to learn more about.

Redlining a process by which banks and other institutions refuse to offer mortgages or offer worse rates to customers in certain neighborhoods based on their racial and ethnic composition is one of the clearest examples of institutionalized racism in the history of the United States. Although the practice was formally outlawed in 1968 with the passage of the Fair Housing Act it continues in various forms. Checklist Number One-Your Market.

It controlled for nine economic and social factors including an applicants income the amount of the loan the ratio of the size of the loan to the applicants income and the type of lender as. Before there were laws that expressly prohibited discrimination in lending a practice known as redlining prevented minorities from accessing credit. The term refers to the presumed practice of mortgage lenders of drawing red lines around portions of a map to indicate areas.

Redlining Redlining is the practice of denying a creditworthy applicant a loan for housing in a certain neighbor hood even though the applicant may otherwise be eligible for the loan. How are you delivering your products to your geographical region. This article originally appeared as the cover story in the SeptemberOctober 2019 issue of ABA Bank Compliance magazine.

What Is Redlining. Now before you read this if you have high blood pressure make sure you take your medication because this checklist may get you fired up. Redlining in particular remains a focal point 6 and of course if a Democrat wins the next presidential election redlining and other fair lending issues will reemerge as enforcement priorities.

Todays checklist helps you review any issues you may have with how you get your products to market. FDIC Fair Lending Contacts Fair Lending Examination Specialist Rose Egbuiwe at REgbuiweFDICgov Examination Specialist Dominick Sciame at DSciameFDICgov 23. First even though fair lending enforcement appears to have been deprioritized since President Trump took office it has not disappeared.

A closer look at the latter two practices reveals how fair lending laws can help address cases where consumers are denied services for discriminatory. As mortgage bankers we. Advocates and legislators fought for the fair lending laws in order to address several practices including discriminatory loan underwriting pricing and marketing.

![]() Evaluating Redlining Risk In Mortgage And Consumer Lending Adi Consulting

Evaluating Redlining Risk In Mortgage And Consumer Lending Adi Consulting

![]() Infographic 8 Critical Components Of A Fair Lending Compliance Program Adi Consulting

Infographic 8 Critical Components Of A Fair Lending Compliance Program Adi Consulting

Fair Lending Cases Filed By Plaintiffs Alleging Reverse Redlining Download Table

Fair Lending Cases Filed By Plaintiffs Alleging Reverse Redlining Download Table

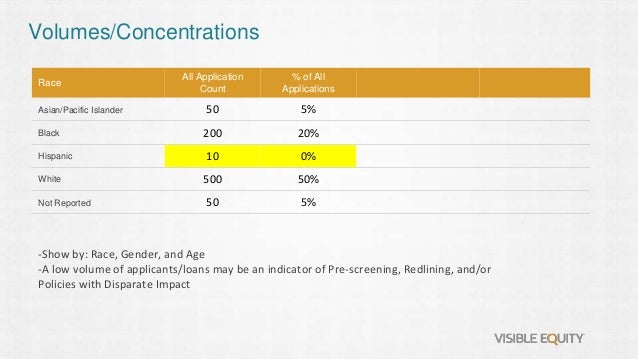

Fair Lending Testing And Analysis Made Easy

Fair Lending Testing And Analysis Made Easy

Understanding Fair Lending Risk In The Credit Process Redlining Youtube

Understanding Fair Lending Risk In The Credit Process Redlining Youtube

Where Have All The Cfpb Fair Lending Cases Gone American Banker

Where Have All The Cfpb Fair Lending Cases Gone American Banker

Redlining The Doj S Initiative On Fair Lending Penn Undergraduate Law Journal

Lending Fair Housing Center Of Central Indiana Indianapolis Indiana

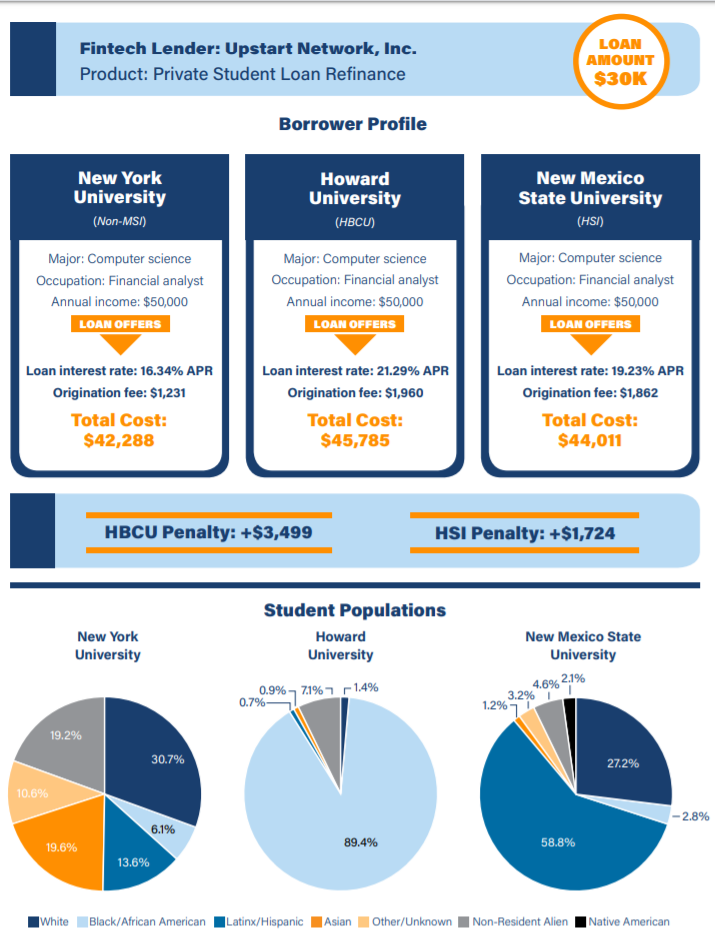

Fintech Lenders Responses To Senate Probe Heighten Fears Of Educational Redlining Student Borrower Protection Center

Fintech Lenders Responses To Senate Probe Heighten Fears Of Educational Redlining Student Borrower Protection Center

Fair Lending Laws And The Cra Complementary Tools For Increasing Equitable Access To Credit

Fair Lending Laws And The Cra Complementary Tools For Increasing Equitable Access To Credit

3 Simple Strategies To Avoid Cra Fair Lending And Redlining Risk

Fair Housing Mini Series Part Ii Redlining Casa

Fair Housing Mini Series Part Ii Redlining Casa

Comments

Post a Comment